At the end of the year, gold marked another all-time high, just above $4,500. We believe that the rally will continue into 2026. The shift away from the dollar will continue to drive many central banks and investors into the precious metal. As we approach the turn of the year, we are looking at four high-potential stocks from the gold sector.

Hier finden Sie die deutsche Version!

Gold: Structural Shifts Persist

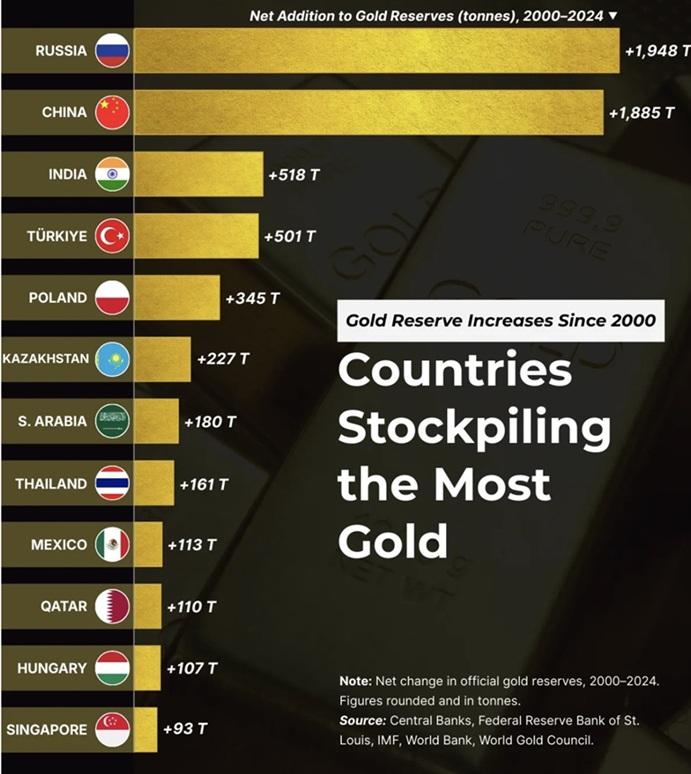

Central banks worldwide – not just the People’s Bank of China (PBOC) – do not want to be vulnerable to pressure from the USA. Traditionally, they hold high stocks of Dollar bonds; after all, someone had to finance Americas debt. But that era seems to be over. For 10 years now, many Asian countries, led by China, have been reducing their dollar holdings. Alongside them, Eastern European states, Türkiye, and more recently Tanzania, have stood out as net gold buyers in the market. The precious metal is the alternative to dollar bonds, because gold has one major advantage: it requires no counterparty. No one can take bars stored in a basement, except in the event of war (see Libya, Iraq, etc.). Since the outbreak of the Ukraine war, the departure from the “greenback” has accelerated. This is partly due to the financial war initiated by the USA against Russia. Following the invasion of Ukraine, the country’s dollar reserves were frozen. Currently, the European Union, among others, is debating what to do with these funds. Under President Donald J. Trump, this process has further solidified. He favors a weak dollar to boost the domestic export economy. Against the Euro alone, the currency has lost more than nine percent this year. This means that central banks, as well as professional bond investors, lost significant money with US Treasuries. With the Federal Reserve’s current policy of rate cuts, we believe this trend will continue into the coming years. Therefore, we share the view of Goldman Sachs or JPMorgan: these investment banks expect the gold price to rise to approximately $5,000 per ounce by the end of 2026.

Gold Stocks: Opportunities in 2026

If this scenario unfolds, gold stocks should be among the winners of 2026. Logically, the higher the gold price, the higher the profit margin. Most producers in North America have costs (AISC) between $1,300 and $1,700 per ounce. At the current gold price, this corresponds to an average profit per ounce of nearly $3,000. Accordingly, industry giants like Agnico Eagle, Newmont, or Barrick Mining have been increasing dividends and launching share buyback programs for several quarters. Furthermore, balance sheets have been cleaned up by paying down debt.

These gold stocks are our top picks!

Investors should therefore prepare for rising payouts and increased share buyback programs in the coming year. Since many companies are virtually “printing money,” we expect an increase in takeovers. Many producers barely invested in their own reserves during the previous “lost decade.” This can now be remedied via acquisitions, as developing new deposits often takes a decade or longer. Many may eye established producers, but many also have their sights on “developers” – companies that have already significantly advanced a gold deposit. As a rule of thumb: anyone with more than 5 million ounces in the ground is a potential takeover candidate for the major miners. These majors prefer to produce from a single mine for decades and are willing to invest billions. Other factors include infrastructure, political stability, and how permitting processes are handled. For mid-tier producers, smaller developers can also be attractive. In the case of junior miners, discoveries are the main draw; good drilling results are the fuel for higher share prices. However, it is also clear: the less advanced a gold developer or explorer is, the higher the risk. Currently, an old stock market wisdom applies: “A rising tide lifts all boats!” We saw this during the previous gold boom in the 2000s.

Our Gold Idea for the 2026 Trading Year

Equinox Gold: Takeover Candidate Due to Asset Sale?

Equinox Gold ($14.90 | CA29446Y5020) attracted attention shortly before the end of the year with a major sale. The company sold its two mines in Brazil, with a total production of around 250,000 ounces, for one billion dollars. This should largely wipe out the company’s debt. On the other hand, the focus is now entirely on North America. In our view, this makes Equinox a takeover candidate for a larger producer. According to its own planning, Equinox will produce 700,000 to 800,000 ounces of gold next year. This is attractive for firms like Agnico Eagle, which have previously acted as buyers exclusively in politically stable regions. Incidentally, the market reacted negatively to the sale of the Brazilian assets. Since the beginning of the year, Equinox stock has nearly tripled, with a majority of the performance occurring in the second half of the year. Investors can either bet on a takeover or on a further rise in the gold price driving the stock. Equinox Gold is currently valued at approximately $11.7 billion.

Asante Gold: Under the Radar

Asante Gold (€1.13 | CA04341X1078) operates one weight class below Equinox. The company is pursuing an ambitious growth program for its two main mines in Ghana (Bibiani and Chirano). According to the five-year forecast updated in May 2025 and confirmed in late 2025, the company plans a production of at least 450,000 ounces for 2026. For comparison: this would be an increase of around 34 percent compared to the previous year. Importantly, Asante can leverage synergies: the two mines are only about 15 km apart, utilizing a haul road to optimize logistics and ore transport. In the past, the company struggled to secure proper financing, but these issues were resolved in September. However, the stock significantly lags behind the market development of gold miners. In our opinion, there are two reasons for this: First, investors are misled by costs of around $4,500 per ounce produced from the Q3 figures. A company like Asante, which invests heavily in expanding its mines, naturally incurs higher costs. This issue should resolve as the mines continue to ramp up in 2026. Second, board member Carsten Korch, a Danish entrepreneur, passed away in May. He reportedly held around four percent of the shares. As we learned at the 121 Mining conference in London in November, the heirs have been selling his shares since then. This could very well explain the underperformance. Furthermore, there were large sell orders in the book shortly before Christmas. We hear the company has no contact with the heirs and does not know how many shares may still hit the market. However, we believe the majority of the shares have already been sold. We have therefore taken an initial position in the stock and are considering increasing it (please note the disclaimer). Investors should also note: Both mines are in Ghana. Alongside Senegal and Ivory Coast, we consider it the most stable country in West Africa. According to the latest Fraser Institute report (published July 29, 2025), Ghana ranks a stable 46th worldwide – leading within West Africa ahead of Senegal (53rd) and Ivory Coast (55th). Across Africa, only Morocco (18th), Botswana (20th), and Zambia (28th) rank higher. P.S. In the medium term, Asante Gold could become a potential takeover target for companies active in West Africa, such as Endeavour Mining or Barrick Mining.

Quimbaya Gold: The Bet on the Neighbour!

We have been on board with the explorer Quimbaya Gold (C$ 0,59 | CA74841L1013) since the financing in February 2025 (please note the disclaimer). Our investment thesis is quite simple: gold mineralization does not end at property boundaries. But first: under the leadership of CEO and founder Alexandre P. Boivin, Quimbaya Gold secured mining rights adjacent to the Segovia mine of Aris Mining in Colombia. You should know: Segovia is the highest-grade mine in South America. Quimbaya’s strategic focus is on its Tahami project. The southern part is only five kilometers from Aris and directly borders their property. The project now covers approximately 25,000 hectares. In early November, Quimbaya closed a financing round of C$ 14.4 million, despite originally intending to raise only C$ 10 million. These fresh funds enable an aggressive exploration strategy without short-term capital needs. Operationally, the ongoing drilling campaign at Tahami South marks a turning point. For the first time, two mineralized vein systems were identified there. Samples taken in the summer also yielded high gold grades. The type of mineralization, with quartz-dominated veins and sulfide accompaniment, corresponds to the regionally known Segovia style. This confirms our thesis that mineralization does not stop at property lines. However, the litmus test is still pending, as results from the drilling program (increased to 4,000 meters) are expected in early 2026. Since its initial listing in February, the stock has gained around 80 percent in Euro terms—though it was significantly higher at times. Analysts at Couloir Capital have set a price target of C$ 1.60 for 2026 and see substantial potential. We are betting on good drilling results, as that is the “hard currency” of exploration firms. If they deliver, the share price should ignite. But again: Quimbaya Gold is an exploration company. The opportunities are great, but the risks are significantly higher than with established producers. They are not for beginners or nervous types, but for seasoned investors willing to take high risks.

Barrick Mining: Break-up Fantasies!

Barrick Mining (45.60 USD | CA06849F1080) was certainly one of the biggest disappointments of recent years. Once the world’s largest gold producer, it was overtaken by Newmont. In 2024, a dispute with the government of Mali, including the confiscation of produced gold, weighed on the stock. CEO Mark Bristow had to leave this year, and now everything has changed. A settlement has been reached with the government in Mali. But for us, the far more important news came on December 1st. Barrick announced that management is evaluating a spin-off and IPO of its North American gold assets. All North American gold projects are to be transferred into a new, independent listed entity (provisionally called “NewCo”). The goal is to make the value of the North American assets more “visible” by creating a “pure play” focused on gold in politically stable regions. Barrick had previously presented itself much more as a copper miner, which is why it changed its name from Barrick Gold to Barrick Mining. The new company is to include the world’s largest gold complex, Nevada Gold Mines (NGM, a JV with Newmont), Pueblo Viejo (a major mine in the Dominican Republic), and Fourmile (also in Nevada). Interim CEO Mark Hill surely intends to meet the desire of many shareholders for more security in stable jurisdictions. The “old” Barrick could then push forward its much riskier portfolio with assets in Africa and Pakistan. The review of the IPO scenario is expected to continue until early 2026. An official update on progress is slated for February 2026, alongside the 2025 annual results. A spin-off could attract many new investors. Accordingly, the stock could continue the run it started in the second half of 2025. Competitors Newmont and Agnico Eagle have a valuation advantage that Barrick needs to close.

Conclusion: We have presented four stocks here that we believe can outperform the gold sector in 2026. There are certainly many other exciting stories out there that could take off. However, the fact remains: even we (unfortunately) do not have a crystal ball; therefore, these assessments, like all forecasts, are subject to uncertainty. But we believe structural trends in the gold market will continue in the coming years. Geopolitics simply overshadows everything here. At the same time, we consider the general stock market, especially in the USA, to be massively overvalued and see gold stocks as an alternative. Finally, we would like to point out our disclaimer. Please always perform your own due diligence before investing and note that, in the worst case, everything can go wrong! The stock market is no walk in the park.

Disclaimer: the German-language version applies (see below).

Graphics: Das Investor Magazin

_____________________________________________________________________________________

DISCLAIMER. BITTE UNBEDINGT BEACHTEN!

Hinweis auf mögliche Interessenskonflikte gemäß Paragraph 34 WpHG i.V.m. FinAnV: Mitarbeiter, Berater und freie Redakteure von www.investor-magazin.de können jederzeit Aktien an allen vorgestellten Unternehmen halten, kaufen oder verkaufen. Das gilt ebenso für abgeleitete Finanzinstrumente, Kryptowährungen oder Rohstoffe. Sollte ein Mitarbeiter, Berater oder freier Redakteur zum Zeitpunkt der Veröffentlichung eines der hier genannten Wertpapiere besitzen, wird dies an dieser Stelle genannt. Der Autor besitzt folgende der im Artikel genannten Aktien oder Finanzprodukte: Asante Gold, Quimbaya Gold. Hinweis auf Interessenkonflikte: Es besteht eine entgeltliche Auftragsbeziehung zwischen dem Herausgeber und einem im Text vorgestellten Unternehmen (Quimbaya Gold). Daher besteht hier ein eindeutiger Interessenkonflikt.

Zudem weisen wir gerne auf die Broschüren der BaFin zum Schutz vor unseriösen Angeboten hin:

– Geldanlage – Wie Sie unseriöse Anbieter erkennen (pdf/113 KB)

– Wertpapiergeschäfte – Was Sie als Anleger beachten sollten (pdf/326 KB)

Risikohinweis: Wir weisen darauf hin, dass der Erwerb von Wertpapieren jeglicher Art hohe Risiken birgt, die zum Totalverlust des eingesetzten Kapitals führen können – oder darüber hinaus. Jegliche auf dieser Webseite verbreiteten Artikel rufen explizit nicht zum Kauf oder Verkauf von Wertpapieren auf. Es kommt weder eine Anlageberatung noch ein Anlagevermittlungsvertrag mit dem Leser zustande. Die hier dargestellten Informationen beziehen sich auf das Unternehmen oder den Markt und nicht auf die persönliche Situation des Lesers. Grundsätzlich möchten wir Ihnen Ideen für unseres Erachtens aussichtsreiche Investments geben. Bitte passen Sie diese dann an Ihre individuelle Strategie und persönliche Finanzsituation an. Und bitte vergessen Sie nicht: Wir haben keine Glaskugel, wir haben aber viel Erfahrung und Wissen. Daher raten wir stets dazu, dass Sie als Leser Ihren Kopf benutzen und Ihre eigenen Analysen erstellen sollten: Do your own Due Dilligence!

Datenschutz: Wir geben Ihre Daten nicht an externe Dritte weiter. Aufgrund der neuen Datenschutz Grundverordnung haben wir unsere Datenschutzerklärung aktualisiert.

Keine Haftung für Links: Mit Urteil vom 12. Mai 1998 hat das Landgericht Hamburg entschieden, dass man durch die Ausbringung eines Links die Inhalte der verlinkten Seiten ggf. mit zu verantworten hat. Dies kann nur dadurch verhindert werden, dass man sich ausdrücklich von diesem Inhalt distanziert. Für alle Links auf dieser Webseite gilt: Der Betreiber distanziert sich hiermit ausdrücklich von allen Inhalten aller verlinkten Seiten und macht sich diese Inhalte nicht zu Eigen.

Keine Finanzanalyse: Der Herausgeber weist ausdrücklich darauf hin, dass es sich bei den Besprechungen um keine Finanzanalysen nach deutschem Kapitalmarktrecht handelt, sondern um journalistische und/oder werbliche Texte. Sie erfüllen deshalb nicht die Anforderungen zur Gewährleistung der Objektivität von Anlageempfehlungen. Bitte beachten Sie außerdem: Die Nutzung dieses Informationsangebots ist ausschließlich Personen vorbehalten, die ihren dauerhaften Wohnsitz in der Bundesrepublik Deutschland haben.

Urheberrecht: Der Inhalt und die Struktur dieser Webseite sind urheberrechtlich geschützt und Eigentum des Betreibers. Sie dürfen nicht ohne vorherige schriftliche Zustimmung weder verwendet noch reproduziert werden, auch nicht auszugsweise. Der Betreiber ist bestrebt, in allen seinen Publikationen die Urheberrechte der verwendeten Grafiken, Bilder und Texte zu beachten. Allein aufgrund der bloßen Nennung oder Nichtnennung von Rechten Dritter ist nicht der Schluss zu ziehen, dass diese nicht geschützt sind! Sollte der Betreiber dennoch gegen Rechte Dritter verstoßen haben, wird er unter dem Vorbehalt der Prüfung unverzüglich jegliche Dateien entfernen, sofern er auf die Rechtsverletzung schriftlich hingewiesen wurde.

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr