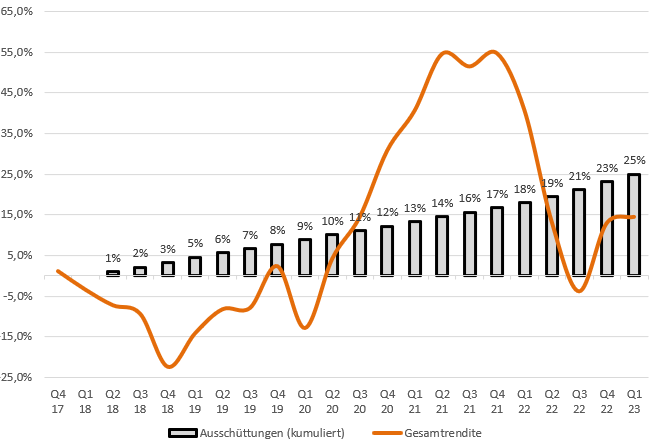

Fund manager Felix Gode is optimistic about the midmarket and small caps in Germany. With his Alpha Star dividend fund, he focuses on small caps with leading positions in their markets. In this guest article, Gode analyzes the situation on the German stock market and presents two stocks from his portfolio.

Catch-up potential for German small caps

The situation on the stock markets has been quite interesting in the first weeks of 2023. Many investors are puzzling over how it is that German blue chips in particular are proving so robust. By way of comparison, since the beginning of the year, Germany’s leading index, the DAX, has risen by 12%, while the U.S. Dow Jones has not even risen by 1%. The broader S&P 500 index is also clearly behind the DAX, with a gain of only 5%. Last but not least, German blue chips have also clearly outperformed small caps recently. Normally, it is the case that the DAX follows the pace set by the US indices. Not so at the moment. So what is the reason for this untypical price behavior?

Short squeeze at DAX companies

Over the past year, we have seen severe dislocations on stock markets around the globe. The reasons for this are obvious. The Ukraine war, inflation, along with rising interest rates, rising prices and shortages in commodities and inputs such as chips. A cocktail that suggested bad things to come. The stock markets have reflected precisely these fears and have gone down in the past year on a scale we have not seen for a long time.

Investors bet on a sharp recession as a result of the multiple challenges, and many market participants also bet precisely on this by taking large short positions on German companies. Cyclical companies in particular were the target. There are plenty of these in the DAX. We now know what has happened on the economic side since then. We are a long way from a sharp recession. At least up to this point. Rather, German companies have coped enormously well with the difficulties, and so the German economy as a whole has also performed valiantly.

The stock markets have been anticipating this development since October, resulting in an unprecedented recovery rally. In addition to the better-than-expected economy, another contributing factor was that it became clear that the rise in interest rates would come to an end in the foreseeable future. This realization, in turn, has been forcing investors to rethink their bets on falling prices for some time now and to stock up again. Since cyclical large caps have been the overwhelming target for short bets, prices here have been rising particularly strongly since October 2022. Small caps outside the indices have therefore lagged behind in terms of returns since the beginning of the year.

DAX stocks still the best choice?

So to a large extent, we are dealing with technical effects. Nevertheless, it remains questionable how the economy will develop in the coming months. Who is to say that interest rates will not rise even further? Perhaps the expected recession will also follow with a slight delay later in the year? The scenario is at least within the realm of possibility.

Therefore, small caps are the right choice in my view. Not only has a catch-up potential been created, small companies also have quite different advantages. After all, small and medium-sized companies are much more often active in dynamically growing areas than broadly positioned large corporations, and these areas are even largely independent of the economic cycle. These are referred to as structural growth markets.

Companies with leading positions in such markets can look calmly to what lies ahead. Whether interest rates rise or fall; the recession comes or not: these companies will be able to continue to increase their profits regardless. That doesn’t necessarily mean that the share prices of these stocks can escape all market turmoil. But it does at least mean that they can hold their own operationally, even when the environment becomes more difficult. This gives such shares the potential to make up for any price setbacks very quickly.

Two strong small caps

Two such examples are the Austrian Frequentis AG and the Berlin software company IVU AG. We are invested in both companies in our Alpha Star dividend fund.

As a result of the Ukraine war, large sums are being invested globally in improving defense. In the course of this, communication systems are also being renewed and brought up to the latest state of the art. Just recently, Frequentis AG was able to announce an order from the German Federal Armed Forces for IT equipment for the national air defense. In the US, Frequentis has only strengthened itself through acquisitions in 2021 and is in a good position to land one or two large orders. In terms of sales, the world market leader for control center solutions should therefore do well in the coming years. The increasing software share has a positive effect on profits, so that we expect gradual margin increases over time. Frequentis’ business is also not dependent on the economic cycle, which is another aspect that should not be underestimated regarding 2023.

IVU AG is also a global market leader: Here, the focus is on software solutions for transport companies, especially rail transport. IVU’s solutions can be used to optimize personnel and vehicle deployment management, as well as operational processes, which saves transport companies money by increasing efficiency. Last but not least, IVU’s solutions also support the energy transition, which will not succeed without an increased expansion of public transport. Due to an increasing share of recurring revenues from cloud solutions, IVU’s profits are becoming more and more stable, making the business more predictable.

Conclusion: Both companies have been looking at constantly rising revenues and profits for many years. The strong market position makes this possible and gives both companies plenty of scope to reinvest profits and thus open up new growth opportunities. Their good market position is thus consolidated year after year. Whatever the stock markets have in store for investors in the coming months: after the anomaly of the past months, with strong blue chips, small caps are expected to catch up. Those who additionally focus on companies in structural growth areas that are market leaders and highly profitable will be well positioned for all eventualities.

Note: This is a guest article by Felix Gode. The opinions of guest authors do not necessarily reflect those of the editors. As a matter of principle, the editor assumes no responsibility, liability or guarantee for contributions by guest authors. This also applies to the charts, graphics, tables, images and all forward-looking statements used by the guest author. This also applies in particular if readers make financial transactions of any kind as a result of these contributions. Investments in the capital markets are associated with a high level of risk. Investors can lose all of their capital – and more. Remember to do your own due diligence! The content of this website is intended exclusively for readers who are permanent residents of Germany. The German disclaimer applies (see below).

You might also be interested in…

- Obsidian Energy: The big One among the smaller Oil-Producers

- Top 10: The largest Copper-Mines in the World!

- Fund manager Felix Gode: Catch-up potential in German small caps

- Top 10: Best selling Gaming consoles in the World!

- Net Digital: A German payment service provider with AI!

- Share buybacks at recird levels: Will this help in a bear market?

Bilder/Graphiken/Tabellen: Das Investor Magazin

_____________________________________________________________________________________

DISCLAIMER. BITTE UNBEDINGT BEACHTEN!

Grundsätzlicher Hinweis auf mögliche Interessenskonflikte gemäß Paragraph 34 WpHG i.V.m. FinAnV: Mitarbeiter, Berater und freie Redakteure von www.investor-magazin.de können jederzeit Aktien an allen hier vorgestellten Unternehmen halten, kaufen oder verkaufen. Das gilt ebenso für abgeleitete Finanzinstrumente. Sollten der Autor, Mitarbeiter oder freie Redakteure eines der vorgestellten Wertpapiere besitzen, wird dies an dieser Stelle genannt.

Zudem weisen wir gerne auf die Broschüren der BaFin zum Schutz vor unseriösen Angeboten hin:

– Geldanlage – Wie Sie unseriöse Anbieter erkennen (pdf/113 KB)

– Wertpapiergeschäfte – Was Sie als Anleger beachten sollten (pdf/326 KB)

Risikohinweis: Wir weisen darauf hin, dass der Erwerb von Wertpapieren jeglicher Art hohe Risiken birgt, die zum Totalverlust des eingesetzten Kapitals führen können – oder darüber hinaus. Jegliche auf dieser Webseite verbreiteten Artikel rufen explizit nicht zum Kauf oder Verkauf von Wertpapieren auf. Es kommt weder eine Anlageberatung noch ein Anlagevermittlungsvertrag mit dem Leser zustande. Die hier dargestellten Informationen beziehen sich auf das Unternehmen und nicht auf die persönliche Situation des Lesers. Grundsätzlich möchten wir Ihnen Ideen für unseres Erachtens aussichtsreiche Investments geben. Bitte passen Sie diese dann an Ihre individuelle Strategie und persönliche Finanzsituation an. Und bitte vergessen Sie nicht: Wir haben keine Glaskugel, wir haben aber viel Erfahrung und Wissen. Daher raten wir stets dazu, dass Sie als Leser ihre eigenen Analysen vornehmen. Do your own Due Dilligence!

Datenschutz: Wir geben Ihre Daten nicht an externe Dritte weiter. Aufgrund der neuen Datenschutz Grundverordnung haben wir unsere Datenschutzerklärung aktualisiert. Sie können sich für unseren kostenlosen Newsletter hier anmelden. Eine Abmeldung ist jederzeit per Mail an info (at) investor-magazin.de möglich.

Keine Haftung für Links: Mit Urteil vom 12.Mai 1998 hat das Landgericht Hamburg entschieden, dass man durch die Ausbringung eines Links die Inhalte der verlinkten Seiten ggf. mit zu verantworten hat. Dies kann nur dadurch verhindert werden, dass man sich ausdrücklich von diesem Inhalt distanziert. Für alle Links auf dieser Webseite gilt: Der Betreiber distanziert sich hiermit ausdrücklich von allen Inhalten aller verlinkten Seiten und macht sich diese Inhalte nicht zu Eigen.

Keine Finanzanalyse: Der Herausgeber weist ausdrücklich darauf hin, dass es sich bei den Besprechungen um keine Finanzanalysen nach deutschem Kapitalmarktrecht handelt, sondern um journalistische und/oder werbliche Texte. Sie erfüllen deshalb nicht die Anforderungen zur Gewährleistung der Objektivität von Anlageempfehlungen. Bitte beachten Sie außerdem: Die Nutzung dieses Informationsangebots ist ausschließlich natürlichen Personen vorbehalten, die ihren dauerhaften Wohnsitz in der Bundesrepublik Deutschland haben. Allen anderen natürlichen oder juristischen Personen oder Personengruppen ist die Nutzung wie auch der Zugang zu dieser Webseite nicht gestattet.

Urheberrecht: Der Inhalt und die Struktur dieser Webseite sind urheberrechtlich geschützt und Eigentum des Betreibers. Sie dürfen nicht ohne vorherige schriftliche Zustimmung weder verwendet noch reproduziert werden, auch nicht auszugsweise. Der Betreiber ist bestrebt, in allen seinen Publikationen die Urheberrechte der verwendeten Grafiken, Bilder und Texte zu beachten. Allein aufgrund der bloßen Nennung oder Nichtnennung von Rechten Dritter ist nicht der Schluss zu ziehen, dass diese nicht geschützt sind! Sollte der Betreiber dennoch gegen Rechte Dritter verstoßen haben, wird er unter dem Vorbehalt der Prüfung unverzüglich jegliche Dateien entfernen, sofern er auf die Rechtsverletzung schriftlich hingewiesen wurde.

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr