A study by Yale University came to the conclusion 20 years ago that copper would be the first of the industrial metals to experience shortages in the long term. Today, this opinion is common sens. Copper is indispensable for renewable energies, electric cars and the decarbonization of societies. Copper prices have benefited little from this, but Ero Copper’s share price has.

Note; You would like to read this article including all graphics? Then please click here.

Little movement in the copper price

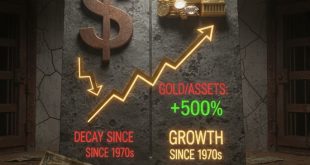

A study by Yale University came to the conclusion 20 years ago that copper would be the first of the industrial metals to experience shortages in the long term. Copper is indispensable for renewable energies, electric cars and the decarbonization of societies. In recent years, many commodity analysts have made the shiny red metal their favorite. However, the development over the past five years is sobering: the price of copper has only just risen from 3 U.S. dollars per pound to 4 U.S. dollars per pound, with heavy fluctuations. The two mining giants BHP Group and Rio Tinto have hardly benefited from this. By contrast, the price of Ero Copper (19.33 US$), a relatively unknown copper producer with its headquarters in Vancouver and mines in Brazil, has risen by 200 percent over the past five years, albeit with equally high volatility. This year alone, it has already risen by 40 percent.

Three mines in Brazil, Growth under its own steam

At 1.6 billion euros, Ero Copper has roughly the same stock market value as the medium-sized precious metals producer Equinox Gold. Compared to the well-known producers of industrial metals, however, Ero Copper is a pipsqueak, but has performed classes better than, for example, Hudbay Minerals, a competitor that plays in the same league. The difference could not be greater: The two market leaders, BHP Group and Rio Tinto, are currently focusing mainly on share buybacks and dividends, but stay away from launching new projects that devour billions and take ten years or more to come into production. Ero Copper is expanding in Brazil, realising growth projects step by step, which the company can realise with limited financial risk and in a manageable time frame.

The people behind Ero Copper

Ero Copper was founded in May 2016 by David Strang and Christopher Noel Dunn. Dunn is chairman and previously worked as an investment banker for Goldman Sachs, Strang was president and CEO of Lumina Copper until its acquisition by First Quantum in August 2014. Chief Geologist Michael Richard was previously Director of Exploration for Latin America at Lundin Mining. Three interesting names from the board of directors: Lyle Braaten works full-time for Lumina Gold and Luminex, Steven Busby is COO of Pan American Silver, John Wright was involved in the founding of Equinox Resources and Pan American Silver and was President and COO there. The mining companies mentioned here all belong/have belonged to the sphere of influence of Ross Beaty or the Lundin family – in this respect, Ero Copper is in good tradition. The day-to-day business in Brazil is managed by Eduardo De Come and Joao Zanon, two Brazilians.

Copper production doubled in six years – a success story

The track record of this team since the IPO in October 2017 is impressive:

- In fiscal 2017, 20,133 tons of copper concentrate were produced from underground mining at the Pilar mine (Bahia state), which had been closed due to alleged resource depletion; by 2022, this figure had risen to 46,371 tons. The once run-down mine was turned into the highly profitable Caraiba mining complex with several mining sites supplying a central processing plant (see photo). This complex is being steadily expanded with moderate capital investment.

- In February 2022, the Board of Directors approved the construction of the Tucuma Mine in Para State: construction started in the second quarter of 2022, with first production scheduled for Q3 2024. Construction costs amount to $294 million. The economic ratios are well above the industry average, with an IRR of 41.8% and an payback period of only 1.4 years.

- In addition, Ero Copper operates the small Xavantina gold mine, which produces about 40,000 ounces of gold per year at low costs.

By 2025, copper production is expected to increase by 125% to between 100,000 and 110,000 tons per year, while gold mining is expected to increase by 40% to between 55,000 and 60,000 ounces. To enable this growth, high double-digit or low triple-digit million dollar amounts have been spent each year. In exploration, $20-40 million is invested per year – a relatively large amount for a company of this size. In 2022, CapEx was at a record high of nearly 300 million due to the start-up of several projects simultaneously.

Financing: No dilution of shareholders

It is interesting how Ero Copper is financing this growth. Since the IPO, shareholders have not been asked to pay once. Cash flow from operations has been used (2021: $264.6 million, 2022: $143.4 million). In 2021, a streaming agreement was also signed with Royal Gold for 25% of gold production, which added US$ 100 million to the coffers. In February 2022, US$400 million of eight-year, 6.5% annual interest bonds were sold to institutional investors in the US. As a result, available liquidity at the end of 2022 was US$ 392.4 – more than sufficient for the expenditures expected in the coming years.

We are on Twitter!

Mining costs in the lowest quantile

Ero Copper is proud that its mining costs are in the lowest quartile compared to other mining companies. However, Ero Copper was not completely spared from the cost increases of the past years. Cash costs per pound of copper, for example, rose from 0.77 (2021) to 1.36 US dollars per pound (2022). The figures for gold: cash costs increased from US$525 (2021) to US$550 per ounce (2022), AISC from US$732 (2021) to US$1,124 (2022).

A solid investment, albeit volatile

Reading through five and a half years of press releases, one is struck: Ero Copper has always exceeded its own forecasts. Nevertheless, after a wild rollercoaster ride, the share price is currently barely higher than it was in July 2019. The chart comparison shows: The share reacts violently to changes in the copper price. This in turn – like the prices of other raw materials, but also of gold and silver – became the plaything of the US Federal Reserve. Its pronouncements on interest rates and the economy are registered with excessive precision by the financial markets. As narratives, they determine the long and short bets of traders on the futures markets, where not only gold and silver, but also copper is traded. If these violent price fluctuations did not exist, Ero Copper would be the ideal stock for conservative investors. Regarding the valuation: The 14 analysts who follow the company consider the price potential to be exhausted after the strong increase this year. If the investor portal Simply Wall St has its way, the stock is trading 58.2% below its fair value. This is where the contradictions lie that investors need to resolve for themselves.

Please note: The author owns shares in Equinix Gold. Investments in the capital markets are associated with a high level of risk. Investors can lose all of their capital – and more. Remember to do your own due diligence! The content of this website is intended exclusively for readers who are permanent residents of Germany. The German disclaimer applies (see below).

You might also be interested in…

- Obsidian Energy: The big One among the smaller Oil-Producers

- Top 10: The largest Copper-Mines in the World!

- Fund manager Felix Gode: Catch-up potential in German small caps

- Top 10: Best selling Gaming consoles in the World!

- Net Digital: A German payment service provider with AI!

- Share buybacks at record levels: Will this help in a bear market?

harts/Tabellen: Das Investor Magazin, Ero Copper

_____________________________________________________________________________________

DISCLAIMER. BITTE UNBEDINGT BEACHTEN!

Grundsätzlicher Hinweis auf mögliche Interessenskonflikte gemäß Paragraph 34 WpHG i.V.m. FinAnV: Mitarbeiter, Berater und freie Redakteure von www.investor-magazin.de können jederzeit Aktien an allen vorgestellten Unternehmen halten, kaufen oder verkaufen. Das gilt ebenso für abgeleitete Finanzinstrumente. Sollte dies der Fall sein, wird dies an dieser Stelle genannt. Der Autor besitzt Aktien von Equinox Gold.

Zudem weisen wir gerne auf die Broschüren der BaFin zum Schutz vor unseriösen Angeboten hin:

– Geldanlage – Wie Sie unseriöse Anbieter erkennen (pdf/113 KB)

– Wertpapiergeschäfte – Was Sie als Anleger beachten sollten (pdf/326 KB)

Risikohinweis: Wir weisen darauf hin, dass der Erwerb von Wertpapieren jeglicher Art hohe Risiken birgt, die zum Totalverlust des eingesetzten Kapitals führen können – oder darüber hinaus. Jegliche auf dieser Webseite verbreiteten Artikel rufen explizit nicht zum Kauf oder Verkauf von Wertpapieren auf. Es kommt weder eine Anlageberatung noch ein Anlagevermittlungsvertrag mit dem Leser zustande. Die hier dargestellten Informationen beziehen sich auf das Unternehmen und nicht auf die persönliche Situation des Lesers. Grundsätzlich möchten wir Ihnen Ideen für unseres Erachtens aussichtsreiche Investments geben. Bitte passen Sie diese dann an Ihre individuelle Strategie und persönliche Finanzsituation an. Und bitte vergessen Sie nicht: Wir haben keine Glaskugel, wir haben aber viel Erfahrung und Wissen. Daher raten wir stets dazu, dass Sie als Leser ihre eigenen Analysen vornehmen. Do your own Due Dilligence!

Datenschutz: Wir geben Ihre Daten nicht an externe Dritte weiter. Aufgrund der neuen Datenschutz Grundverordnung haben wir unsere Datenschutzerklärung aktualisiert. Sie können sich für unseren kostenlosen Newsletter hier anmelden. Eine Abmeldung ist jederzeit per Mail an info (at) investor-magazin.de möglich.

Keine Haftung für Links: Mit Urteil vom 12.Mai 1998 hat das Landgericht Hamburg entschieden, dass man durch die Ausbringung eines Links die Inhalte der verlinkten Seiten ggf. mit zu verantworten hat. Dies kann nur dadurch verhindert werden, dass man sich ausdrücklich von diesem Inhalt distanziert. Für alle Links auf dieser Webseite gilt: Der Betreiber distanziert sich hiermit ausdrücklich von allen Inhalten aller verlinkten Seiten und macht sich diese Inhalte nicht zu Eigen.

Keine Finanzanalyse: Der Herausgeber weist ausdrücklich darauf hin, dass es sich bei den Besprechungen um keine Finanzanalysen nach deutschem Kapitalmarktrecht handelt, sondern um journalistische und/oder werbliche Texte. Sie erfüllen deshalb nicht die Anforderungen zur Gewährleistung der Objektivität von Anlageempfehlungen. Bitte beachten Sie außerdem: Die Nutzung dieses Informationsangebots ist ausschließlich natürlichen Personen vorbehalten, die ihren dauerhaften Wohnsitz in der Bundesrepublik Deutschland haben. Allen anderen natürlichen oder juristischen Personen oder Personengruppen ist die Nutzung wie auch der Zugang zu dieser Webseite nicht gestattet.

Urheberrecht: Der Inhalt und die Struktur dieser Webseite sind urheberrechtlich geschützt und Eigentum des Betreibers. Sie dürfen nicht ohne vorherige schriftliche Zustimmung weder verwendet noch reproduziert werden, auch nicht auszugsweise. Der Betreiber ist bestrebt, in allen seinen Publikationen die Urheberrechte der verwendeten Grafiken, Bilder und Texte zu beachten. Allein aufgrund der bloßen Nennung oder Nichtnennung von Rechten Dritter ist nicht der Schluss zu ziehen, dass diese nicht geschützt sind! Sollte der Betreiber dennoch gegen Rechte Dritter verstoßen haben, wird er unter dem Vorbehalt der Prüfung unverzüglich jegliche Dateien entfernen, sofern er auf die Rechtsverletzung schriftlich hingewiesen wurde.

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr