In good times, tanker stocks are true cash machines. But when there is a stiff breeze at the markets, then doom is foreseen. Currently, the market seems to be pricing in the end of business once again. This gives courageous investors the chance to pick up low-valued stocks with high dividend yields at low prices. One of these countercyclical opportunities is the share of DHT Holdings.

After record year: The tanker blues are being played on the markets!

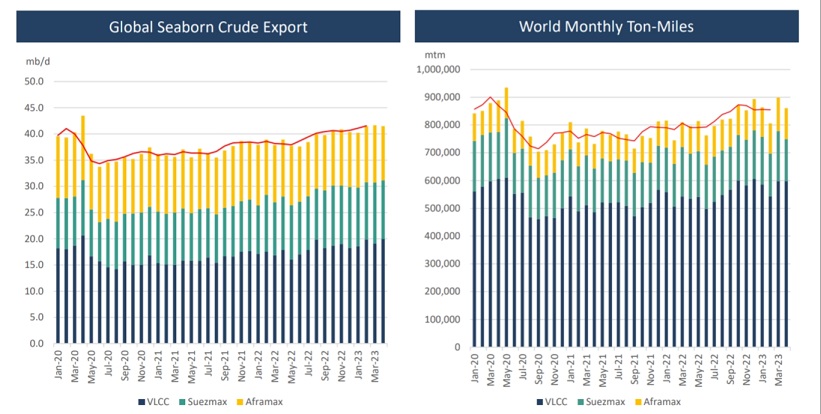

Due to the sanctions against Russia, the cards in the international oil business have been reshuffled. Completely new supply chains emerged. Crude oil, but also products derived from it such as gasoline or diesel, are now increasingly transported across the oceans and over much greater distances. This drove up freight rates for supertankers. For the owners of the ships, 2022 was a year of turnaround that began with a quarter of losses and ended with record profits – with share prices rising sharply accordingly.

Economic worries, but also the news published at the beginning of April that the OPEC+ countries intend to reduce production from May, abruptly ended this rally. The opportunity for investors: Some of the shares in this sector are valued at ridiculously low levels, and lavish dividends await. We have taken a closer look at this extremely cyclical sector. One favorite: DHT Holdings (NYSE: DHT | US$ 8.02).

High profits or huge losses: Tankers are an extremely cyclical business!

Oil demand has increased by an average of 1.1 million barrels per day per year since 1990. Accordingly, tanker shipping has also grown – albeit not in a straight line, but in the form of boom and bust cycles. When the outlook seemed good, too many new ships were put into service. This spoiled the prices. As old ships were scrapped, freight rates picked up again. Currently, we are in a phase of good demand, but hardly any new tankers are being built due to sharply rising costs for newbuildings. This is positive from the point of view of the industry. A tanker has an economic life of 15-25 years.

Companies such as Scorpio Tankers, Frontline plc or DHT Holdings function in principle like a car rental company, where the chauffeur is also rented out. They provide a ship with crew. This is chartered by state oil producers, international oil companies or commodity trading companies. The market is divided into the transport of crude oil and of processed products such as gasoline and diesel. There are supertankers in three categories:

- A Very Large Crude Carrier (VLCC) has a transport capacity of up to 2 million barrels.

- Suezmax, loaded with up to 1 million barrels of crude oil, can just about pass through the Suez Canal.

- Aframax, with up to 600,000 barrels, is mainly suitable for smaller ports.

Freight rates came back sharply from their high

When OPEC+ countries announced on April 2 that they would cut production by 1.15 million barrels per day from May, tanker share prices plunged by up to 10 percent. They have been on a downward trend ever since. Investors’ logic: if less oil is produced, less is transported. The “shocker” was then an article in the Bloomberg news agency at the beginning of May, according to which in the previous six weeks daily rentals for VLCC-class supertankers on the Middle East-China route had plummeted from a March high of $97,000 to less than $24,000. In May a year ago, however, they had been below US$20,000 – a level at which a tanker would only incur losses.

Anyone working their way through the websites of tanker companies quickly realizes that the figures quoted by Bloomberg are only reference values. About half of the freight rates are fixed by longer-term contracts – and at quite profitable levels. Contracts are awarded on the spot market through auctions. Here, the reference price offers only a point of reference. The age and quality of the ship are also decisive factors.

Shares for courageous investors and dividend hunters

On April 14, the research house Pareto Securities published a rather positive research report on the tanker sector. Nine companies were presented with their key figures. According to this report, actually all stocks from the sector are strongly undervalued according to traditional key figures such as price/NAV and P/E ratio. The dividend yields expected for 2023 and 2024 are on average around 15 percent.

Follow us on Twitter!

Operating a tanker fleet is a capital-intensive business as far as the acquisition of the ships is concerned. However, as freight rates rise, the ships become true “cash machines.” The free cash flows generated in good years are used to pay down debt, but also for share buybacks and dividends.

DHT Holdings: The “conservative” among the big tanker stocks!

DHT Holdings (NYSE: DHT | US$ 8.02) headquartered in Bermuda and with management companies in Monaco, Norway and Singapore, is one of the more conservative industry players, with a very low debt level and a large share of fixed charter contracts. With CapEx on newbuildings down to more or less zero, virtually all profits are currently distributed to shareholders as dividends. Whether the dividend yields of 14 percent (2023e) and 19 percent (2024e) expected by Pareto Securities will be achieved, however, is questionable. This is because the latest quarterly figures did not turn out as expected by analysts. Profit in Q1 2023 was +$38 million, up from -$17.3 million a year ago, but down from $61.8 million in Q4 2022. Following the fluctuating freight rates, revenue also developed.

Tanker market: long-term trends intact

Investment bank Jefferies then downgraded DHT Holdings to “hold” from “buy” and cut its price target to $10 from $12. DHT’s second-quarter bookings declined as expected, but freight rates remained high, Jefferies analyst Omar Notka said. Daily rentals booked through the spot market currently average $70,300, as well as $55,800 for the entire fleet. However, Notka took spot rate predictions for VLCC tankers down significantly from $50,000 to $30,000/day for Q3 2023 and from $50,000 to $40,000/day for Q4 2023. However, as the expected volatile profits fluctuate, so do the expected dividends. Breakeven for a tanker in Q2-Q4 2023 averages $26,000/day (when all costs are considered) and $16,000/day (cash breakeven). DHT Holdings’ management expressed optimism at the presentation of the quarterly figures, despite short-term volatility. This is because the three pillars for the company’s success remain intact:

- More oil is exported by sea

- Longer distances are covered

- Hardly any new ships come onto the market.

The long-term chart of DHT Holdings and its competitors shows that the industry has seen much better times 15 years ago. The DHT share price high was $200 in 2007. A sharp decline was followed by a ten-year bottoming out between 2012 and 2022, with lows as low as US$3. In 2022, resistance at 8 US dollars was overcome. In 2023, the price returned to it from above. The strong undervaluation, especially according to substance criteria, together with attractive freight rates in the medium term could lead the share back to its old heights. In general, hardly any market participants expect less oil to be produced and consumed in the foreseeable future. On the contrary, 2022 was a record year in this respect.

Please note: Investments in the capital markets are associated with a high level of risk. Investors can lose all of their capital – and more. Remember to do your own due diligence! The content of this website is intended exclusively for readers who are permanent residents of Germany. The German disclaimer applies (see below).

You might also be interested in…

- Xortx Therapeutics: Now it’s time for the final spurt!

- Delignit: Back on track!

- Beaconsmind: Digital solutions for store-based business

- Nippon Sanso: Moat und catch-up potential

- Ero Copper: A copper producer that hardly anyone knows

- Obsidian Energy: The big One among the smaller Oil-Producers

- Ranking: The largest Copper-Mines in the World!

- Fund manager Felix Gode: Catch-up potential in German small caps

- Ranking: Best selling Gaming consoles in the World!

- Net Digital: A German payment service provider with AI!

- Share buybacks at record levels: Will this help in a bear market?

harts/Tabellen: Das Investor Magazin, DHT Holdings, Stock Watch

_____________________________________________________________________________________

DISCLAIMER. BITTE UNBEDINGT BEACHTEN!

Grundsätzlicher Hinweis auf mögliche Interessenskonflikte gemäß Paragraph 34 WpHG i.V.m. FinAnV: Mitarbeiter, Berater und freie Redakteure von www.investor-magazin.de können jederzeit Aktien an allen vorgestellten Unternehmen halten, kaufen oder verkaufen. Das gilt ebenso für abgeleitete Finanzinstrumente. Sollte dies der Fall sein, wird dies an dieser Stelle genannt.

Zudem weisen wir gerne auf die Broschüren der BaFin zum Schutz vor unseriösen Angeboten hin:

– Geldanlage – Wie Sie unseriöse Anbieter erkennen (pdf/113 KB)

– Wertpapiergeschäfte – Was Sie als Anleger beachten sollten (pdf/326 KB)

Risikohinweis: Wir weisen darauf hin, dass der Erwerb von Wertpapieren jeglicher Art hohe Risiken birgt, die zum Totalverlust des eingesetzten Kapitals führen können – oder darüber hinaus. Jegliche auf dieser Webseite verbreiteten Artikel rufen explizit nicht zum Kauf oder Verkauf von Wertpapieren auf. Es kommt weder eine Anlageberatung noch ein Anlagevermittlungsvertrag mit dem Leser zustande. Die hier dargestellten Informationen beziehen sich auf das Unternehmen und nicht auf die persönliche Situation des Lesers. Grundsätzlich möchten wir Ihnen Ideen für unseres Erachtens aussichtsreiche Investments geben. Bitte passen Sie diese dann an Ihre individuelle Strategie und persönliche Finanzsituation an. Und bitte vergessen Sie nicht: Wir haben keine Glaskugel, wir haben aber viel Erfahrung und Wissen. Daher raten wir stets dazu, dass Sie als Leser ihre eigenen Analysen vornehmen. Do your own Due Dilligence!

Datenschutz: Wir geben Ihre Daten nicht an externe Dritte weiter. Aufgrund der neuen Datenschutz Grundverordnung haben wir unsere Datenschutzerklärung aktualisiert. Sie können sich für unseren kostenlosen Newsletter hier anmelden. Eine Abmeldung ist jederzeit per Mail an info (at) investor-magazin.de möglich.

Keine Haftung für Links: Mit Urteil vom 12.Mai 1998 hat das Landgericht Hamburg entschieden, dass man durch die Ausbringung eines Links die Inhalte der verlinkten Seiten ggf. mit zu verantworten hat. Dies kann nur dadurch verhindert werden, dass man sich ausdrücklich von diesem Inhalt distanziert. Für alle Links auf dieser Webseite gilt: Der Betreiber distanziert sich hiermit ausdrücklich von allen Inhalten aller verlinkten Seiten und macht sich diese Inhalte nicht zu Eigen.

Keine Finanzanalyse: Der Herausgeber weist ausdrücklich darauf hin, dass es sich bei den Besprechungen um keine Finanzanalysen nach deutschem Kapitalmarktrecht handelt, sondern um journalistische und/oder werbliche Texte. Sie erfüllen deshalb nicht die Anforderungen zur Gewährleistung der Objektivität von Anlageempfehlungen. Bitte beachten Sie außerdem: Die Nutzung dieses Informationsangebots ist ausschließlich natürlichen Personen vorbehalten, die ihren dauerhaften Wohnsitz in der Bundesrepublik Deutschland haben. Allen anderen natürlichen oder juristischen Personen oder Personengruppen ist die Nutzung wie auch der Zugang zu dieser Webseite nicht gestattet.

Urheberrecht: Der Inhalt und die Struktur dieser Webseite sind urheberrechtlich geschützt und Eigentum des Betreibers. Sie dürfen nicht ohne vorherige schriftliche Zustimmung weder verwendet noch reproduziert werden, auch nicht auszugsweise. Der Betreiber ist bestrebt, in allen seinen Publikationen die Urheberrechte der verwendeten Grafiken, Bilder und Texte zu beachten. Allein aufgrund der bloßen Nennung oder Nichtnennung von Rechten Dritter ist nicht der Schluss zu ziehen, dass diese nicht geschützt sind! Sollte der Betreiber dennoch gegen Rechte Dritter verstoßen haben, wird er unter dem Vorbehalt der Prüfung unverzüglich jegliche Dateien entfernen, sofern er auf die Rechtsverletzung schriftlich hingewiesen wurde.

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr