The natural gas markets went crazy in 2022 as a result of the Ukraine war. The shares of Tourmaline Oil also benefited from this. The Canadians are one of the largest gas producers in North America. The stock offers a lot of dividends and a low valuation. On top of that, the chances of higher gas prices seem to have increased.

Natural gas: From the fringe to the center

For years and decades, natural gas was uninteresting from an investor’s perspective. It was cheap and abundant; in North America, the price often barely covered the cost of production. The Ukraine war and the West’s Russia sanctions radically changed the situation. Suddenly, this commodity was a scarce resource, and the price multiplied in 2022 – bad for consumers, extremely lucrative for gas producers and their shareholders. However, oil and gas came down significantly since the fall of 2022 from the record highs reached last year and marked a low a few weeks ago. As a result, the share prices of companies active in this sector also fell. It is being discussed whether or when it is worthwhile to re-enter the market. After all, according to key figures such as P/E ratio, price/NAV and dividend yield, this sector is attractive. Tourmaline Oil, Canada’s largest and North America’s fifth largest natural gas producer, is worth considering.

Mike Rose: An impressive success story

Tourmaline Oil (62,25 C$ | TSX: TOU) is not a stock that every investor knows. But the company has an interesting history that is associated with one name: Michael “Mike” L. Rose. Now 65, he founded Tourmaline Oil, is president, CEO and chairman, and was awarded the Canada Lifetime Achievement Award last year in recognition of his life’s work.

Successful management exit strategy

With decades of professional experience and some spectacular successes, Mike Rose is one of the legendary veterans of the North American oil and gas industry. After graduating in 1979, he worked for Shell Canada, where he gained deep insights into the natural gas fields of Alberta and British Columbia. In 1993, he left Shell to found Berkeley Petroleum. In 2001, he sold the company to Anadarko for 1.5 billion Canadian dollars. That same year, he founded Duvernay Oil and then sold that company to his former employer in 2008 for CAD 5.9 billion.

In August 2008, Mike Rose, together with the proven management team of Berkeley Petroleum and Duvernay Oil, founded his third company, Tourmaline Oil. As seed capital, Tourmaline’s management invested CAD 253 million of its own money. In November 2010, combined with a capital increase of CAD 228 million, the company went public. The management acquired 30 percent of the offered shares itself.

Tourmaline Oil: Buy when others (have to) get out!

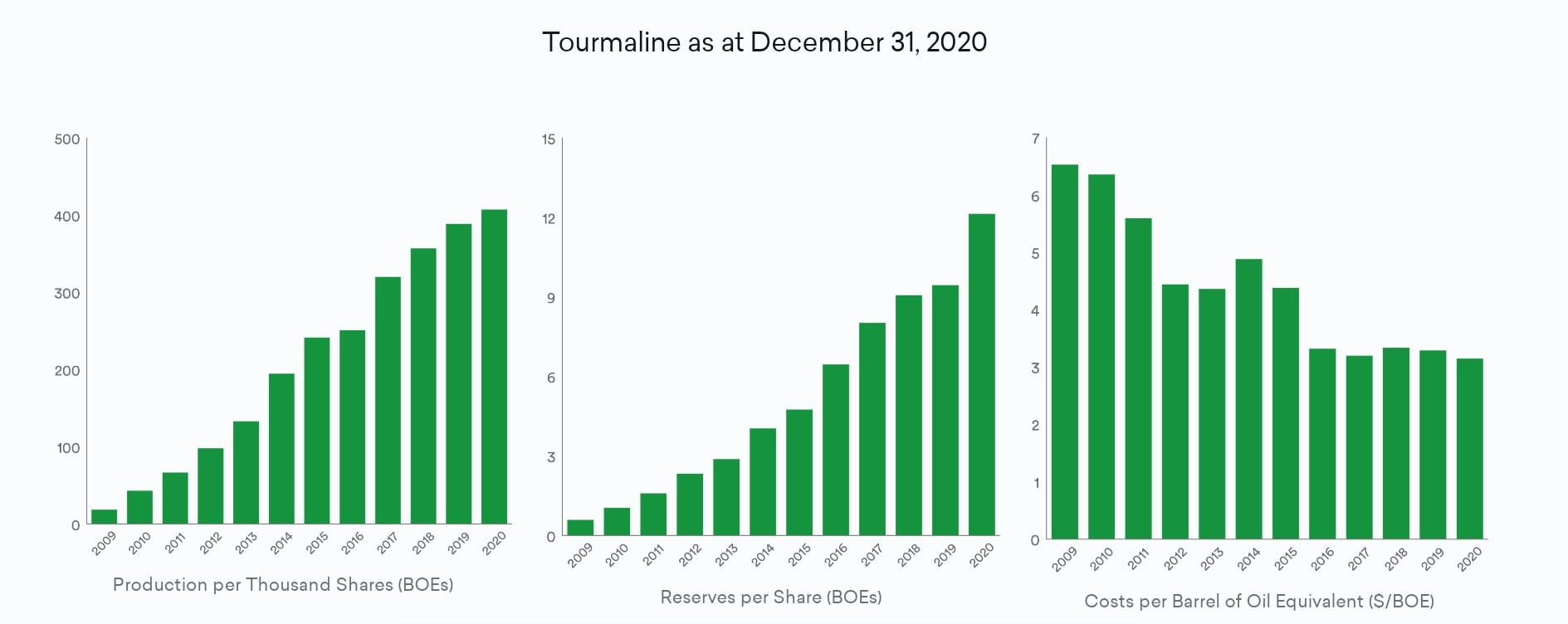

Tourmaline Oil grew rapidly by buying smaller competitors. From the beginning, management was committed to keeping debt ratios low and financing growth with internally generated cash. Tourmaline Oil lost 80% of its share price value from July 2014 to March 2020 due to the decline in gas prices. Nevertheless, the largest acquisitions occurred during this period. When the entire energy market was down because of the Corona pandemic, Tourmaline Oil made corporate acquisitions worth CAD 2.3 billion – paid for in cash and in its own shares. Where others were timid, Mike Rose took bold action.

The company’s growth was indeed impressive: In 2011, Tourmaline Oil produced 23,000 boepd (barrels of oil equivalent per day), and in 2021 “top dog” Canadian Natural Resources was overtaken as Canada’s largest gas producer up to that time. Production exceeded to 500,000 boepd for the first time in 2022 (2021: 441,115 boepd) and is expected to increase further to 520,000-540,000 boepd in 2023: 80% of it natural gas, the rest oil and liquid gas components. The Alberta Deep, Montney and Peace River production areas are all located in the Western Canadian Basin – the region where Mike Rose has worked his entire professional life. Tourmaline Oil’s share price has tripled despite the ups and downs since its IPO twelve and a half years ago.

The “greenest” among Canada’s oil and gas giants

As a gas producer, Tourmaline Oil is also the “greenest” of Canada’s big four energy companies. Its greenhouse gas intensity is less than one-third that of its competitors Canadian Natural Resources, Suncor Energy and Cenovus Energy. By his own admission, Mike Rose is building “an oil company for the post-oil era. Mike talks about natural gas as a long-term solution to our energy needs in the transition to renewables, which will take several decades,” said Chris Potter, chief executive of Calgary-based investment bank Peters & Co.

Tourmaline Oil 2022: Year of records

2022 was a record year for Tourmaline Oil, and one that will likely be difficult to repeat. It was a combination of both: The company reaped the rewards of its expansion, which had made it not only Canada’s largest gas producer, but also North America’s most cost-efficient. This was because the numerous acquisitions had not only resulted in the purchase of gas fields, but also of a great deal of midstream infrastructure, including 9,200 km of pipelines. Added to this was the high price of gas due to the crisis. On March 1, 2023, Tourmaline Oil published its figures for the last fiscal year:

Revenue: CAD 7.74 billion (+66% y-o-y).

Cash flow: CAD 4.88 billion (+67%)

Net profit: CAD 4.49 billion (+121%)

Earnings per share: CAD 13.10 (+105%)

Capital expenditure (CapEx): CAD 1.88 billion (+18%)

Debt as of 12/31/2022: CAD 494 million (-49%)

Dividends: CAD 7.90 per share in regular and special dividends was paid out of free cash flow of CAD 3.2 billion, representing a dividend yield of 12% based on an average share price of CAD 66.94

In fiscal 2023, production is expected to increase slightly to 520,000-540,000 boepd (Q1 2023: 525,916 boepd). Due to lower oil and gas prices, the company expects cash flow to decrease to CAD 3.8 billion. 50% to 90% of the expected CAD2 billion free cash flow is also expected to be paid out in dividends in 2023. At a share price of CAD 60, this results in a free cash flow yield of 10%.

Where is the gas price headed?

The key unknown in Tourmaline Oil’s earnings projections is the price of natural gas, which is even more volatile than the price of oil. The company has hedged about 30% of production through futures contracts. This provides some planning certainty, but of course the gas producer is not independent of price fluctuations.

Follow us on Twitter!

Based on demand estimates from the International Energy Agency (IEA) and in view of foreseeable problems (OPEC+ production cut, decline in US fracking), an increasing number of observers expect a supply deficit for oil and gas in the second half of 2023. This year will also be the first time more money will flow into solar than oil, an IEA forecast showed. Author Zoltan Ban published a well-researched article on the Seeking Alpha investor portal titled “A Few Months Away From Potential Start Of Global Energy Crisis.” For anyone who owns shares in oil and gas producers, this is good news.

Tourmaline Oil: An Attractive Investment?

Conclusion: Short-term forecasts are also difficult or impossible here. In the longer term, Tourmaline Oil should be an attractive investment. Company insiders certainly seem to be of this opinion. They have bought a large number of shares in the past twelve months. The share price is well protected on the downside with a P/E ratio of around 5 and a double-digit dividend yield in percentage terms. The company is a cost leader and has little debt. Since the expansion of renewable energies is taking place much more slowly than is actually necessary, the prices for all fossil energy sources will rise in the near future. At least, that is how many analysts see it, especially since there is little investment in the oil and gas sector overall. Tourmaline Oil is well positioned here in the natural gas sector. Production is expected to increase to up to 800,000 boepd in the coming years. The capital for this is available, as are the gas resources, which will last for the next 75 years.

Marketing is also assured. For example, the first gas was delivered to Cheniere Energy‘s liquefaction plant in Corpus Christi in January 2023. A gas liquefaction plant on Canada’s Pacific coast is under construction. Bad for us Europeans: This LNG will be exported to Asia.

Please note: Investments in the capital markets are associated with a high level of risk. Investors can lose all of their capital – and more. Remember to do your own due diligence! The content of this website is intended exclusively for readers who are permanent residents of Germany. The German disclaimer applies (see below). The author owns shares in Canadian Natural Resources.

You might also be interested in…

- Banyan Gold: New Gold rush in the Yukon!

- Xortx Therapeutics: Now it’s time for the final spurt!

- Delignit: Back on track!

- Beaconsmind: Digital solutions for store-based business

- Nippon Sanso: Moat und catch-up potential

- Ero Copper: A copper producer that hardly anyone knows

- Obsidian Energy: The big One among the smaller Oil-Producers

- Ranking: The largest Copper-Mines in the World!

- Fund manager Felix Gode: Catch-up potential in German small caps

- Ranking: Best selling Gaming consoles in the World!

- Net Digital: A German payment service provider with AI!

- Share buybacks at record levels: Will this help in a bear market?

Charts/Graphics/Tables: Das Investor Magazin, Banyan Gold

_____________________________________________________________________________________

DISCLAIMER. BITTE UNBEDINGT BEACHTEN!

Grundsätzlicher Hinweis auf mögliche Interessenskonflikte gemäß Paragraph 34 WpHG i.V.m. FinAnV: Mitarbeiter, Berater und freie Redakteure von www.investor-magazin.de können jederzeit Aktien an allen vorgestellten Unternehmen halten, kaufen oder verkaufen. Das gilt ebenso für abgeleitete Finanzinstrumente. Sollte dies der Fall sein, wird dies an dieser Stelle genannt. Der Autor hält Aktien von Canadian Natural Resources.

Zudem weisen wir gerne auf die Broschüren der BaFin zum Schutz vor unseriösen Angeboten hin:

– Geldanlage – Wie Sie unseriöse Anbieter erkennen (pdf/113 KB)

– Wertpapiergeschäfte – Was Sie als Anleger beachten sollten (pdf/326 KB)

Risikohinweis: Wir weisen darauf hin, dass der Erwerb von Wertpapieren jeglicher Art hohe Risiken birgt, die zum Totalverlust des eingesetzten Kapitals führen können – oder darüber hinaus. Jegliche auf dieser Webseite verbreiteten Artikel rufen explizit nicht zum Kauf oder Verkauf von Wertpapieren auf. Es kommt weder eine Anlageberatung noch ein Anlagevermittlungsvertrag mit dem Leser zustande. Die hier dargestellten Informationen beziehen sich auf das Unternehmen und nicht auf die persönliche Situation des Lesers. Grundsätzlich möchten wir Ihnen Ideen für unseres Erachtens aussichtsreiche Investments geben. Bitte passen Sie diese dann an Ihre individuelle Strategie und persönliche Finanzsituation an. Und bitte vergessen Sie nicht: Wir haben keine Glaskugel, wir haben aber viel Erfahrung und Wissen. Daher raten wir stets dazu, dass Sie als Leser ihre eigenen Analysen vornehmen. Do your own Due Dilligence!

Datenschutz: Wir geben Ihre Daten nicht an externe Dritte weiter. Aufgrund der neuen Datenschutz Grundverordnung haben wir unsere Datenschutzerklärung aktualisiert. Sie können sich für unseren kostenlosen Newsletter hier anmelden. Eine Abmeldung ist jederzeit per Mail an info (at) investor-magazin.de möglich.

Keine Haftung für Links: Mit Urteil vom 12.Mai 1998 hat das Landgericht Hamburg entschieden, dass man durch die Ausbringung eines Links die Inhalte der verlinkten Seiten ggf. mit zu verantworten hat. Dies kann nur dadurch verhindert werden, dass man sich ausdrücklich von diesem Inhalt distanziert. Für alle Links auf dieser Webseite gilt: Der Betreiber distanziert sich hiermit ausdrücklich von allen Inhalten aller verlinkten Seiten und macht sich diese Inhalte nicht zu Eigen.

Keine Finanzanalyse: Der Herausgeber weist ausdrücklich darauf hin, dass es sich bei den Besprechungen um keine Finanzanalysen nach deutschem Kapitalmarktrecht handelt, sondern um journalistische und/oder werbliche Texte. Sie erfüllen deshalb nicht die Anforderungen zur Gewährleistung der Objektivität von Anlageempfehlungen. Bitte beachten Sie außerdem: Die Nutzung dieses Informationsangebots ist ausschließlich natürlichen Personen vorbehalten, die ihren dauerhaften Wohnsitz in der Bundesrepublik Deutschland haben. Allen anderen natürlichen oder juristischen Personen oder Personengruppen ist die Nutzung wie auch der Zugang zu dieser Webseite nicht gestattet.

Urheberrecht: Der Inhalt und die Struktur dieser Webseite sind urheberrechtlich geschützt und Eigentum des Betreibers. Sie dürfen nicht ohne vorherige schriftliche Zustimmung weder verwendet noch reproduziert werden, auch nicht auszugsweise. Der Betreiber ist bestrebt, in allen seinen Publikationen die Urheberrechte der verwendeten Grafiken, Bilder und Texte zu beachten. Allein aufgrund der bloßen Nennung oder Nichtnennung von Rechten Dritter ist nicht der Schluss zu ziehen, dass diese nicht geschützt sind! Sollte der Betreiber dennoch gegen Rechte Dritter verstoßen haben, wird er unter dem Vorbehalt der Prüfung unverzüglich jegliche Dateien entfernen, sofern er auf die Rechtsverletzung schriftlich hingewiesen wurde.

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr