Marathon Gold is currently building its first gold mine in Newfoundland. The company is still comparatively lowly valued on the stock market and is trading near its five-year low. It offers opportunities for long-term investors who want to build positions in the gold sector.

Newfoundland: Titanic and Gold Rush

Newfoundland is Canada’s large Atlantic island, off which the Titanic sank in 1912 and a few weeks ago an expedition failed. The island is about seventy times the size of Gran Canaria, but there was also a gold rush here that broke out decades ago and attracted quite a few junior exploration companies. Marathon Gold (MOZ | 0.81 C$) has been the most successful so far on this vast island in terms of concrete results. The company is currently building the largest gold mine in the Atlantic region of Canada. Marathon Gold’s Valentine Gold Project is already fully funded and 27% complete (as of March 31). The stock is nevertheless trading near its 5-year low, providing opportunities for risk-averse investors.

A real insider tip for private investors

Marathon Gold is covered by no less than eight bank analysts – a very high number for a company with a stock market value of only 395 million C$. Someone searching YouTube for interviews with the CEO, CFO or chief geologist will find only limited coverage. There is hardly a junior mining company that does so little advertising. Although the company is well known among institutional investors, this stock is probably still an insider tip for most private investors.

Mining financing with renowned partners

If you work your way through Marathon Gold’s press releases, you will learn that the decision to build the mine was announced on September 1, 2022. Its construction costs of US$ 350 million have already been more than fully financed with renowned partners:

- In September 2022, a capital increase (“bought deal”) of 150 million US dollars took place with the broker Canaccord Genuity as lead manager. The price per unit (shares and warrants) was US$1.10.

- In January 2023, a bond agreement already concluded in March 2022 with a special fund of Sprott Inc. was increased from 185 to 225 million US dollars. Key terms: Interest rate per annum: 7% + LIBOR or + 2.5%. In addition, starting July 31, 2025, Marathon Gold must pay Sprott US$17 for each gold ounce produced until 1.6 million ounces of gold have been produced. This equates to a total of US$27.2 million. In addition, 10 million share purchase warrants with an exercise price of C$ 1.35 have been issued as consideration for the bond increase. The bond matures on December 31, 2027.

- In June 2022, Marathon Gold secured equipment financing from US giant Caterpillar in the amount of US$81 million.

- There was a 2% Net Smelter Royalty (NSR) with royalty company Franco-Nevada from when Marathon Gold was an exploration company. Of this, Marathon Gold has already bought back 0.5% for US$7 million. In June 2023, the NSR was increased to 3% by Franco-Nevada for US$45 million.

Follow us on Twitter

In this split of equity, debt and royalty, this is not an uncommon mine financing. One can argue about the question whether some of the conditions are “cut-throat” (which is also done). However, the volume of this financing, as well as the partners involved in it, clearly speak to Marathon Gold’s Valentine project. Funders like these don’t invest without closer scrutiny; after all, together it’s about $500 million.

Open pit mining at unusually high ore grade

The updated Feasibility Study (“Feasibilty Study”), released in December 2022, calls for ore to be mined in three adjacent open pits. The ore grade is unusually high for an open pit at 1.62 grams of gold per tonne of rock (g/t). Proven & Probable (PP) reserves are 2.7 million ounces. Production per year is expected to be 195,000 ounces, with a mine life of 14.3 years. In the base scenario – an assumed gold price of US$1,700/ounce – this would result in an after-tax Net Present Value (NPV) of CAD648 million and an IRR of 22%. Construction costs would be covered after 2.8 years, and annual free cash flow would be C$ 121 million. Should the gold price maintain the current level, these ratios would improve accordingly. However, at an assumed gold price of US$1,700, the company also has a comfortably large downside buffer to meet its financial targets.

A Mine with a lot of exploration potential

The geological trend on which the mine is located is 32 kilometers long. There’s a lot of exploration potential there. It is known that the ore bodies of the open pit are open to the bottom. That hasn’t been explored in any detail yet either. But at some point in 15 or 20 years, the open pit could become an underground mine. This is also quite common with such deposits. Gold is very likely to be mined at this site for a long time, much longer than the 14.3 years mentioned above.

Marathon Gold’s valuation is low

Marathon Gold comes to a market value of about C$ 390 million at current share price levels. How expensive or cheap is that? In its presentation, the company itself draws comparisons to Sabina Gold & Silver /B2Gold) and Great Bear Resources (Kinross Gold), which were both acquired for C$ 1.1 billion and C$ 1.35 billion, respectively. Sabina’s Back River project compares quite well to Marathon Gold’s Valentine project. Both mines are under construction and are expected to deliver first gold in Q1 2025. Comparing how many dollars you pay for an ounce of gold resources, you come to the conclusion that Marathon Gold is valued about half as much as Sabina by the stock market (US$62/ounce vs. US$120/ounce). For gold reserves, the ratio is US$117/ounce to US$306/ounce. And B2Gold paid a rather moderate price, i.e. low premium, when it took over Sabina.

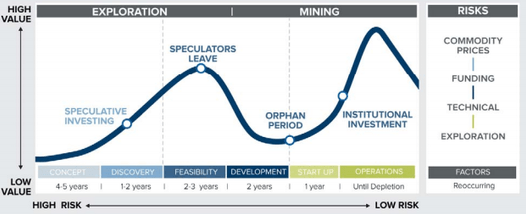

The perfect example: the Lassonde curve!

Looking at the chart, we can see that Marathon Gold correlates only slightly with the benchmark VanEck Junior Gold Miners (GDXJ), but follows the Lassonde curve relatively well. This model, widely known in the industry and developed by the famous Franco-Canadian geologist Pierre Lassonde, represents the ideal-typical price development of a mining stock from the discovery of a deposit to the start of production (see above; more on Pierre Lassonde).

Our conclusion: With increasing exploration successes, combined with growing investor euphoria, Marathon Gold’s share price has risen sharply. This is a very typical development in the industry. In the “boring” phase, when the feasibility study was prepared, the financing of the mine was clarified and the still missing permits were obtained, the “hot money” got out. The share price fell sharply. However, the price seems to be stabilizing now. If one follows the Lassonde curve, conservative investors should discover the share and the price should rise successively as construction of the mine continues. The analysts’ price targets are between C$ 1.50 to 3.50 (current price: C$ 0.81). So they see a doubling potential and more. The risks are no longer so high, since the construction is fully financed and the permits have been issued. Nevertheless, there is no free lunch in the construction of a mine either. Thus, as with all such construction projects, there is a risk of delays or the occurrence of technical problems at this stage. As a result, the start of operations may be delayed and therefore the time at which Marathon Gold will generate free cash flows may also be delayed.

Please note: Investments in the capital markets are associated with a high level of risk. Investors can lose all of their capital – and more. Remember to do your own due diligence! The content of this website is intended exclusively for readers who are permanent residents of Germany. The German disclaimer applies (see below).

You might also be interested in…

– Ranking: The most innovative Companies in the World

– Tourmaline Oil: Betting on a higher natural gas price

– Banyan Gold: New Gold rush in the Yukon!

– DHT Holdings: Tankers as cash machines

– Ranking: The largest Copper-Mines in the World!

– Xortx Therapeutics: Now it’s time for the final spurt!

– Delignit: Back on track!

– Beaconsmind: Digital solutions for store-based business

– Nippon Sanso: Moat und catch-up potential

– Ero Copper: A copper producer that hardly anyone knows

– Obsidian Energy: The big One among the smaller Oil-Producers

– Ranking: Best selling Gaming consoles in the World!

– Net Digital: A German payment service provider with AI!

Graphics: Das Investor Magazin, Marathon Gold

_____________________________________________________________________________________

DISCLAIMER. BITTE UNBEDINGT BEACHTEN!

Grundsätzlicher Hinweis auf mögliche Interessenskonflikte gemäß Paragraph 34 WpHG i.V.m. FinAnV: Mitarbeiter, Berater und freie Redakteure von www.investor-magazin.de können jederzeit Aktien an allen vorgestellten Unternehmen halten, kaufen oder verkaufen. Das gilt ebenso für abgeleitete Finanzinstrumente. Sollte dies der Fall sein, wird dies an dieser Stelle genannt. Der Autor hält Aktien von Canadian Natural Resources.

Zudem weisen wir gerne auf die Broschüren der BaFin zum Schutz vor unseriösen Angeboten hin:

– Geldanlage – Wie Sie unseriöse Anbieter erkennen (pdf/113 KB)

– Wertpapiergeschäfte – Was Sie als Anleger beachten sollten (pdf/326 KB)

Risikohinweis: Wir weisen darauf hin, dass der Erwerb von Wertpapieren jeglicher Art hohe Risiken birgt, die zum Totalverlust des eingesetzten Kapitals führen können – oder darüber hinaus. Jegliche auf dieser Webseite verbreiteten Artikel rufen explizit nicht zum Kauf oder Verkauf von Wertpapieren auf. Es kommt weder eine Anlageberatung noch ein Anlagevermittlungsvertrag mit dem Leser zustande. Die hier dargestellten Informationen beziehen sich auf das Unternehmen und nicht auf die persönliche Situation des Lesers. Grundsätzlich möchten wir Ihnen Ideen für unseres Erachtens aussichtsreiche Investments geben. Bitte passen Sie diese dann an Ihre individuelle Strategie und persönliche Finanzsituation an. Und bitte vergessen Sie nicht: Wir haben keine Glaskugel, wir haben aber viel Erfahrung und Wissen. Daher raten wir stets dazu, dass Sie als Leser ihre eigenen Analysen vornehmen. Do your own Due Dilligence!

Datenschutz: Wir geben Ihre Daten nicht an externe Dritte weiter. Aufgrund der neuen Datenschutz Grundverordnung haben wir unsere Datenschutzerklärung aktualisiert. Sie können sich für unseren kostenlosen Newsletter hier anmelden. Eine Abmeldung ist jederzeit per Mail an info (at) investor-magazin.de möglich.

Keine Haftung für Links: Mit Urteil vom 12.Mai 1998 hat das Landgericht Hamburg entschieden, dass man durch die Ausbringung eines Links die Inhalte der verlinkten Seiten ggf. mit zu verantworten hat. Dies kann nur dadurch verhindert werden, dass man sich ausdrücklich von diesem Inhalt distanziert. Für alle Links auf dieser Webseite gilt: Der Betreiber distanziert sich hiermit ausdrücklich von allen Inhalten aller verlinkten Seiten und macht sich diese Inhalte nicht zu Eigen.

Keine Finanzanalyse: Der Herausgeber weist ausdrücklich darauf hin, dass es sich bei den Besprechungen um keine Finanzanalysen nach deutschem Kapitalmarktrecht handelt, sondern um journalistische und/oder werbliche Texte. Sie erfüllen deshalb nicht die Anforderungen zur Gewährleistung der Objektivität von Anlageempfehlungen. Bitte beachten Sie außerdem: Die Nutzung dieses Informationsangebots ist ausschließlich natürlichen Personen vorbehalten, die ihren dauerhaften Wohnsitz in der Bundesrepublik Deutschland haben. Allen anderen natürlichen oder juristischen Personen oder Personengruppen ist die Nutzung wie auch der Zugang zu dieser Webseite nicht gestattet.

Urheberrecht: Der Inhalt und die Struktur dieser Webseite sind urheberrechtlich geschützt und Eigentum des Betreibers. Sie dürfen nicht ohne vorherige schriftliche Zustimmung weder verwendet noch reproduziert werden, auch nicht auszugsweise. Der Betreiber ist bestrebt, in allen seinen Publikationen die Urheberrechte der verwendeten Grafiken, Bilder und Texte zu beachten. Allein aufgrund der bloßen Nennung oder Nichtnennung von Rechten Dritter ist nicht der Schluss zu ziehen, dass diese nicht geschützt sind! Sollte der Betreiber dennoch gegen Rechte Dritter verstoßen haben, wird er unter dem Vorbehalt der Prüfung unverzüglich jegliche Dateien entfernen, sofern er auf die Rechtsverletzung schriftlich hingewiesen wurde.

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr