After the historic gold rush, there is now a new one in the Yukon: Victoria Gold has already opened its gold mine. Neighbor Banyan Gold could be next. The share offers plenty of upside and the company is traded as a takeover candidate.

From the historical to the modern gold rush in the Yukon!

Between 1896 and 1899, the Canadian northern province of Yukon experienced its first gold rush. More than a hundred years later, the region, located on the Alaskan border, was rediscovered. Today, higher precious metal prices and modern exploration methods make it possible to mine ores that were previously considered uneconomic. Victoria Gold (VGCX | C$8,60) opened the Eagle Mine in 2019, the largest gold mining operation the Yukon has seen to date. Open pit mining is used to extract ore with a gold content of just 0.5 grams per ton, and heap leaching is used to extract the metal from the rock – a process now well established in the far north. Banyan Gold (BYN.v | C$ 0,385), a neighbor of Victoria Gold, now offers the chance for the Eagle Mine to become a “Tier 1 Asset”, i.e. a mine with more than 500,000 ounces of annual production.

Banyan Gold: big deposit, but strict cost management!

Tara Christie, a mining engineer with more than 25 years of professional experience – the last ten of which have been in the Yukon – became President & CEO of Banyan Gold in 2016 . Under her leadership, the company acquired a 51 percent interest in the AurMac project in the Yukon in 2017. It also has the option to acquire the remaining 49 percent under relatively easy terms.

In 2020, the first resource estimate for the project was 900,000 ounces of gold, which was rewarded with a five-fold increase in the share price. By May 2022, the resource had grown to four million ounces of gold. Then on May 24, 2023, Banyan presented the latest resource estimate at 6.2 million ounces of gold (details). That’s a size that all gold producers are interested in. Tara Christie is justifiably proud: “That’s a 50 percent increase in just one year. This was achieved with a drill program of 50,000 meters in one season. Banyan continues to focus on growth. We have subsequently already drilled 15,000 meters on the three AurMac Project properties as part of our 2023 exploration program.” The cost to discover one ounce of gold was less than five U.S. dollars. So shareholders’ money has been used very efficiently. This strict cost management has earned Banyan a good name among many investors.

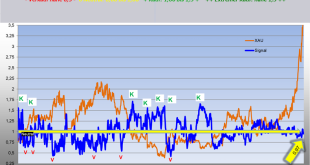

Financially, 2022 was also very encouraging. The share price rose by 16 percent in what was such a difficult stock market year for the mining industry. Through capital increases (private placements), 29.2 million Canadian dollars were raised. The cash balance at the end of the year was CAD 19 million.

AurMac: The next big gold mine in the Yukon!

Paradigm Capital, an investment bank specializing in commodity companies, recently published an extensive research report on Banyan Gold. The company has announced that it will submit a feasibility study (PEA) for at least part of AurMac by 2024. This is necessary because it is required by the option terms to acquire the remaining 49 percent of the project. But it is also helpful in demonstrating the value of the deposit to investors and industrial partners. The drilling program for 2023 must therefore pursue two goals: discovering new gold ounces, but also converting the resource into a mineable reserve through so-called infill drilling.

Follow us on Twitter!

Paradigm Capital believes AurMac can become a twin to Victoria Gold’s Eagle Mine because of similar geology. Their key data are known. Paradigm Capital makes the following assumptions for AurMac:

- Construction cost: $509 million CAD; production cost (AISC): $1,154/oz

- Construction start 2028, production start 2030, mine life: 17 years

- Project NPV of US$804 million or 20.4% IRR at a gold price of US$1,900/ounce

- Eagle Mine annual production is expected to be 200,000-250,000 ounces for the next 15 years. Similar should be true for AurMac

- Banyan Gold: the ideal takeover candidate?

Banyan Gold could build this mine itself, assuming proper financing. If Victoria Gold, which already holds 11.3 percent of the shares, were to take over Banyan Gold, this would have several advantages: Permitting would be expedited because AurMac would then be just an extension of the Eagle Mine. About ten percent in costs would be saved. There would also be the prospect of developing the joint project into a Tier 1 asset. Then you would have 10-20 million ounces of gold in the ground and an annual production of 500,000 ounces. That would be world class. And that would put this mine in league with Canadian Malartic and Detour Lake (both owned by Agnico Eagle), two of the largest gold mines in North America.

Theoretically, Hecla Mining could also be an interested party. The company operates as a direct neighbor the Keno Hill Mine acquired by Alexco in September 2022, as well as Green Creeks in Alaska. With a market capitalization of US$3.7 billion, Hecla Mining could easily take over Banyan Gold and build the mine. One argument against this is that the two mines have nothing in common. AurMac is an open pit mine, hosts gold and has low grades. Keno Hill, on the other hand, is an underground mine with silver and high grades in the rock – and is also technically relatively difficult. It is therefore conceivable that Hecla Mining will enter the market, but Paradigm Capital does not think this is likely.

And it comes after all differently than one thinks!

Paradigm Capital rated Banyan Gold – even before the updated resource estimate of 6.2 million ounces – as a “speculative buy” with a price target of C$ 0.85. That would be, starting from the current level, roughly a doubling of the price. We expect that the bank will soon raise the price target with a study because of the larger resource.

However, Paradigm Capital has not considered an important aspect: John McConnell, the CEO of Victoria Gold, reported in a conversation on the sidelines of the Deutsche Goldmesse in Frankfurt (Germany) in May that there are several prospective buyers for Victoria Gold. Victoria Gold could therefore be taken over itself. This is also the rumor in the industry. McConnell, as CEO, has no influence on this: “If there is a serious takeover bid, the board of directors has to put that to the shareholders for a vote.” The problem from the perspective of Victoria Gold’s shareholders, however, is likely to be the current low price of C$ 8.32 (high above C$ 20, current market value around C$ 540 million). Below C$ 15, it would be difficult for a buyer to make a move here.

The most likely option – classified by Paradigm Capital as complicated but not impossible – is therefore likely to be that one of the large gold miners takes over Victoria Gold and Banyan Gold. This would be attractive and inexpensive: the buyer would get a highly profitable world-class mine with total expenditures of roughly US$2 billion over a ten-year period.

Please note: Investments in the capital markets are associated with a high level of risk. Investors can lose all of their capital – and more. Remember to do your own due diligence! The content of this website is intended exclusively for readers who are permanent residents of Germany. The German disclaimer applies (see below).

You might also be interested in…

- Xortx Therapeutics: Now it’s time for the final spurt!

- Delignit: Back on track!

- Beaconsmind: Digital solutions for store-based business

- Nippon Sanso: Moat und catch-up potential

- Ero Copper: A copper producer that hardly anyone knows

- Obsidian Energy: The big One among the smaller Oil-Producers

- Ranking: The largest Copper-Mines in the World!

- Fund manager Felix Gode: Catch-up potential in German small caps

- Ranking: Best selling Gaming consoles in the World!

- Net Digital: A German payment service provider with AI!

- Share buybacks at record levels: Will this help in a bear market?

Charts/Graphics/Tables: Das Investor Magazin, Banyan Gold

_____________________________________________________________________________________

DISCLAIMER. BITTE UNBEDINGT BEACHTEN!

Grundsätzlicher Hinweis auf mögliche Interessenskonflikte gemäß Paragraph 34 WpHG i.V.m. FinAnV: Mitarbeiter, Berater und freie Redakteure von www.investor-magazin.de können jederzeit Aktien an allen vorgestellten Unternehmen halten, kaufen oder verkaufen. Das gilt ebenso für abgeleitete Finanzinstrumente. Sollte dies der Fall sein, wird dies an dieser Stelle genannt.

Zudem weisen wir gerne auf die Broschüren der BaFin zum Schutz vor unseriösen Angeboten hin:

– Geldanlage – Wie Sie unseriöse Anbieter erkennen (pdf/113 KB)

– Wertpapiergeschäfte – Was Sie als Anleger beachten sollten (pdf/326 KB)

Risikohinweis: Wir weisen darauf hin, dass der Erwerb von Wertpapieren jeglicher Art hohe Risiken birgt, die zum Totalverlust des eingesetzten Kapitals führen können – oder darüber hinaus. Jegliche auf dieser Webseite verbreiteten Artikel rufen explizit nicht zum Kauf oder Verkauf von Wertpapieren auf. Es kommt weder eine Anlageberatung noch ein Anlagevermittlungsvertrag mit dem Leser zustande. Die hier dargestellten Informationen beziehen sich auf das Unternehmen und nicht auf die persönliche Situation des Lesers. Grundsätzlich möchten wir Ihnen Ideen für unseres Erachtens aussichtsreiche Investments geben. Bitte passen Sie diese dann an Ihre individuelle Strategie und persönliche Finanzsituation an. Und bitte vergessen Sie nicht: Wir haben keine Glaskugel, wir haben aber viel Erfahrung und Wissen. Daher raten wir stets dazu, dass Sie als Leser ihre eigenen Analysen vornehmen. Do your own Due Dilligence!

Datenschutz: Wir geben Ihre Daten nicht an externe Dritte weiter. Aufgrund der neuen Datenschutz Grundverordnung haben wir unsere Datenschutzerklärung aktualisiert. Sie können sich für unseren kostenlosen Newsletter hier anmelden. Eine Abmeldung ist jederzeit per Mail an info (at) investor-magazin.de möglich.

Keine Haftung für Links: Mit Urteil vom 12.Mai 1998 hat das Landgericht Hamburg entschieden, dass man durch die Ausbringung eines Links die Inhalte der verlinkten Seiten ggf. mit zu verantworten hat. Dies kann nur dadurch verhindert werden, dass man sich ausdrücklich von diesem Inhalt distanziert. Für alle Links auf dieser Webseite gilt: Der Betreiber distanziert sich hiermit ausdrücklich von allen Inhalten aller verlinkten Seiten und macht sich diese Inhalte nicht zu Eigen.

Keine Finanzanalyse: Der Herausgeber weist ausdrücklich darauf hin, dass es sich bei den Besprechungen um keine Finanzanalysen nach deutschem Kapitalmarktrecht handelt, sondern um journalistische und/oder werbliche Texte. Sie erfüllen deshalb nicht die Anforderungen zur Gewährleistung der Objektivität von Anlageempfehlungen. Bitte beachten Sie außerdem: Die Nutzung dieses Informationsangebots ist ausschließlich natürlichen Personen vorbehalten, die ihren dauerhaften Wohnsitz in der Bundesrepublik Deutschland haben. Allen anderen natürlichen oder juristischen Personen oder Personengruppen ist die Nutzung wie auch der Zugang zu dieser Webseite nicht gestattet.

Urheberrecht: Der Inhalt und die Struktur dieser Webseite sind urheberrechtlich geschützt und Eigentum des Betreibers. Sie dürfen nicht ohne vorherige schriftliche Zustimmung weder verwendet noch reproduziert werden, auch nicht auszugsweise. Der Betreiber ist bestrebt, in allen seinen Publikationen die Urheberrechte der verwendeten Grafiken, Bilder und Texte zu beachten. Allein aufgrund der bloßen Nennung oder Nichtnennung von Rechten Dritter ist nicht der Schluss zu ziehen, dass diese nicht geschützt sind! Sollte der Betreiber dennoch gegen Rechte Dritter verstoßen haben, wird er unter dem Vorbehalt der Prüfung unverzüglich jegliche Dateien entfernen, sofern er auf die Rechtsverletzung schriftlich hingewiesen wurde.

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr