The world is changing rapidly, and at the same time, the relentless trade war between the US and China is raging. The focus is on rare earths, which are virtually indispensable in high-tech products – from submarines, AI chips, wind turbines, and electric motors to stealth bombers. A gold rush broke out in the industry in 2025, with companies such as Arafura, Lynas Rare Earths, MP Materials, and St George Mining taking center stage.

The object of desire does not shine yellow – it is invisibly embedded in our smartphones, powers the motors of electric cars, and is the backbone of modern weapon systems. We are talking about rare earths. The market for these 17 metals is small, with a volume of just a few billion US dollars. But it is expected to grow to US$8 billion by 2032. The superpowers have turned this small market into a geopolitical battlefield.

The trade war: USA vs. China

The origins of the current conflict go back a long way. Under Barack Obama‘s presidency, the US began to shift its strategic focus away from Europe and toward the Pacific region, identifying China as its future main competitor for global dominance. This competition has since escalated into a full-blown trade war. Since Joe Biden took office, trade restrictions have been in place, and Donald Trump has at times sparked an economic war with tariffs. Under various US administrations, sanctions and tariffs have been massively expanded. High-performance chips, AI technologies, and complex machines – such as those from Dutch manufacturer ASML – can no longer be exported to China without further ado. China is responding to this technological isolation with its strongest weapon: dominance over the raw materials markets.

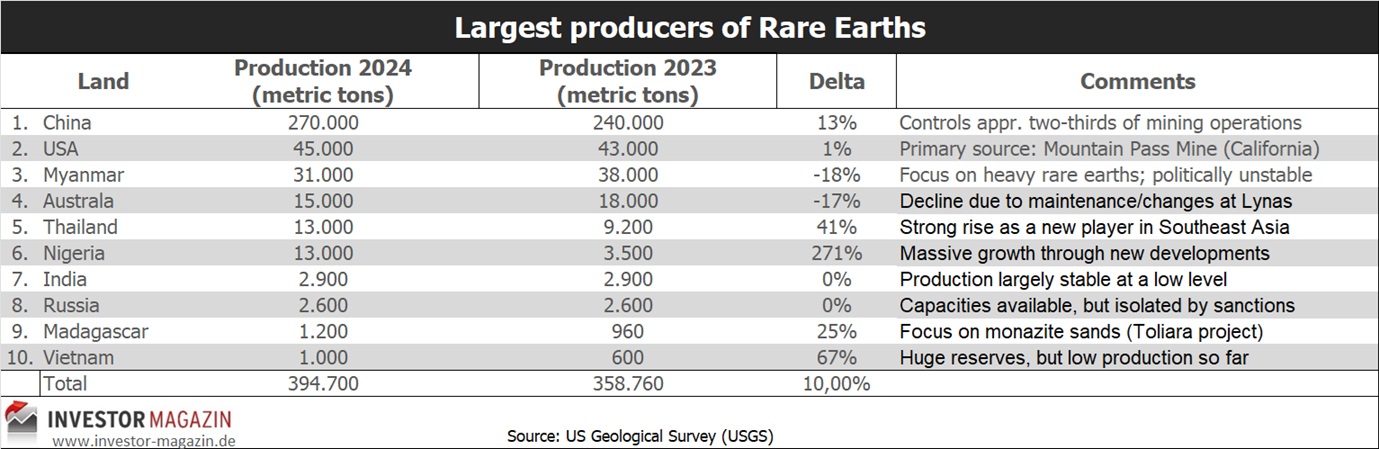

China’s monopoly and the global map

China is now the world’s second-largest economy and the largest consumer of most raw materials. The country also controls around 60 percent of global production and as much as 90 percent of rare earth processing. China even has a monopoly on some rare earths. This quasi-monopoly enables Beijing to hit the West where it hurts. While the US ceased production decades ago due to environmental regulations and low world market prices, China has perfected the entire value chain – from mining to finished high-performance magnets. But China is not alone. Other countries are gaining importance in shifting the balance of power:

- Australia: The most important player outside China, mainly through the company Lynas Rare Earths.

- US: With the Mountain Pass mine, they are attempting a comeback.

- Myanmar & Kazakhstan: Important countries when it comes to reserves, with Myanmar often acting as an extension of Chinese companies. Kazakhstan, on the other hand, is strongly focused on Russia.

- Brazil: Home to the world’s second-largest reserves.

Without magnets, there would be little progress!

There is great concern in the West, as rare earths are indispensable for key industries. China has already stopped deliveries in the past, forcing companies such as Ford to temporarily suspend production. European companies were also affected in the spring of 2024. The situation is seen as particularly critical in the military sector, where demand is high. China has just restricted exports to Japan for the new year. This applies to all companies that manufacture both military and civilian goods (dual use goods).Two examples (source: Center for Strategic and International Studies, CSIS):

- F-35 fighter jet: requires approx. 410 kg of rare earths.

- Virginia-class submarine: consumes around 4.5 tons of raw materials.

Source Center for Strategic and International Studies (CSIS): https://www.csis.org/analysis/consequences-chinas-new-rare-earths-export-restrictions

The turning point? A temporary agreement

In light of the conflict in Ukraine and potential tensions surrounding Taiwan, dependence on China is a strategic nightmare scenario for the Western arms industry. This also applies in view of the recently adopted arms measures in Europe.

At the end of October 2025, the US and China surprisingly reached a respite. An agreement was reached whereby China would suspend its export restrictions for one year. In return, the US lowered tariffs on Chinese products and China committed to increasing agricultural imports and taking measures against the fentanyl trade. It is now known that China has not kept its promise to import large quantities of soybeans from the US. The stock markets reacted cautiously at the time, but there was profit-taking on many stocks. Analysts consider the deal to be fragile. The US’s goal remains unchanged: to completely establish a supply chain independent of China by 2027. However, industry representatives consider this to be impossible. The US is taking the “uranium model” as its example: just as Russian uranium is to disappear from US power plants by 2028 (import share in 2023 around 16%), the Department of Defense has set the goal that from 2027 onwards, no Chinese magnets may be used in US weapons (Source: https://www.acquisition.gov/dfars/252.225-7052-restriction-acquisition-certain-magnets-tantalum-and-tungsten). This is putting massive pressure on the US weapons industry to establish supply chains. But the US government is not sitting idly by either. Massive capital is flowing into the industry:

- MP Materials: Receives hundreds of millions of dollars from the Department of Defense and private investments (including $500 million from Apple) to massively expand the only US mine.

- Australia pact: A memorandum of understanding worth $8.5 billion is intended to strengthen cooperation with Australian miners. However, this is merely a political signal at this stage; nothing has happened yet.

Table: Rare Earth Elements and Their Applications

According to experts, the market for rare earths will grow to a volume of US$8 billion by 2032. Whether the West succeeds in breaking Chinese dominance in the foreseeable future will determine not only stock prices, but also the technological sovereignty of entire continents. However, experts consider it impossible to establish independent supply chains outside China within a few years. The discovery, exploration, development, and construction of a mine usually take a decade or more, see an analysis by S&P Global: https://www.spglobal.com/market-intelligence/en/news-insights/research/from-6years-to-18years-the-increasing-trend-of-mine-lead-times.

However, it is also true that a tremendous amount of money is currently flowing into the sector, allowing the few companies without financing concerns to operate. This is an important advantage given the amounts required. There are probably just over a dozen rare earth projects around the world where efforts are being made. However, many are at a very early stage, so it is not yet clear whether they are economically viable deposits. We have identified four companies that are serious investment candidates: Arafura Rare Earths, Lynas Rare Earths, MP Materials, and St George Mining.

Arafura Rare Earths: A big challenge!

Arafura Rare Earths (ARU | ASX) is an Australian company. Its current market capitalization is around AUD 1.2 billion. Arafura aims to establish itself as an independent supplier to the global electric vehicle and renewable energy industries. The Nolans project is located in Australia’s Northern Territory, approximately 135 kilometers north of Alice Springs. Due to its remote location, far from infrastructure and civilization, construction costs are immense, at more than US$1.3 billion. The net present value (NPV) of the project is around US$1.86 billion in the company’s base case scenario (see here). The IRR is only 17.2 percent. Let’s put it this way: we would immediately reject a gold or copper project with such a low IRR. But this is about geopolitics! Around 90 percent of the planned revenue is to be generated by the extraction of Neodymium (Nd) and Praseodymium (Pr). These are produced as mixed NdPr oxide. Arafura is aiming for an annual production of approximately 4,440 tons. This would cover around 4 to 5 percent of global demand. The two rare earths are indispensable in high-performance permanent magnets, which are needed in electric cars, wind turbines, and robotics. Another plus point: in terms of operating costs, Arafure is on a par with industry leaders and also scores highly with a very long mine life of around 38 years. As is customary in the raw materials sector, the company only generates cash flow once production has started, so it is not possible to analyze it using traditional stock market indicators. All figures and facts mentioned here are taken from the company’s feasibility study (FS).

Arafura’s share price had more than doubled at times over the past six months, but gave up most of its gains after the moratorium between China and the US. As things stand, the final investment decision for the mine construction is due in the first quarter of 2026 (Final Investment Decision). In December 2025, a massive capital increase of over AUD 800 million successfully raised the missing capital. Among others, Australian mining billionaire Gina Rinehart (Hancock Prospecting) came on board as an anchor investor with over AUD 125 million. In addition, there are conditional loan commitments from government institutions totaling approximately US$1.5 billion. Once the final decision has been made in early 2026, the main construction phase will begin. Analysts and the company currently expect commercial production to start in 2028. Full capacity (approx. 4,440 tons of NdPr oxide per year) is expected to be reached by around 2030 to 2032. Construction is taking a long time, even by mining standards, because, unlike simple mines, Arafura wants to build a highly complex chemical processing plant (refinery) directly on site in the desert. This is technically challenging and requires a huge infrastructure (water treatment, energy generation, sulfuric acid plant). Since Arafura aims to be Australia’s first integrated “ore-to-oxide” plant, the technical hurdles are significantly higher than for projects that only want to ship ore concentrate to China.

Lynas Rare Earths: The top dog!

Lynas Rare Earths (LYC | ASX) was for a long time the only western producer of rare earths. The company is virtually the market leader outside China and benefits from already ongoing production. Lynas is currently massively expanding its refining capacities in Australia (Kalgoorlie) and the US. Its strategic partners include Japan, and it also has Gina Reinhart, Australia’s richest woman, on board as a major shareholder and relies on established customer relationships. The heart of the mining operation is the Mt Weld Mine in Australia. It is considered one of the world’s highest-quality deposits of rare earths. Mining is carried out using the classic open pit method. The ore is exceptionally rich in Neodymium and Praseodymium (NdPr). Directly at the mine, the ore is crushed in a concentration plant and processed by flotation. The result is a concentrate that is transported by truck and ship for further processing. Lynas has massively expanded its capacity at Mt Weld to supply enough raw material for 12,000 tons of finished NdPr oxide per year.

The company has strategically divided its production between two locations in order to minimize political and operational risks. The new Rare Earths Processing Facility was opened in Kalgoorlie (Australia) at the end of 2024. It handles the cracking and leaching (breaking down the ore with acid) process. The product is a mixed rare earth carbonate, which is easier and more environmentally friendly to transport than the raw ore concentrate. In Gebeng, Malaysia, the highly complex separation of the individual metals takes place in the refinery (Lynas Advanced Materials Plant, LAMP). Lynas recently started production of heavy rare earths (Dysprosium and Terbium) here and plans to start Samarium production in April 2026. Lynas is currently the only company in the world outside China that can separate and supply both light and heavy rare earths on an industrial scale. Despite occasional power outages in the Australian grid (Kalgoorlie), the company recently reported record sales, driven by strong demand from the Western defense and automotive industries.

In the 2025 financial year (ended June 30), net profit was only AUD 8 million. The sharp decline compared to the previous year (AUD 84.5 million) was due to the high start-up costs of the new factories. EBITDA reached AUD 101.2 million and cash reserves reached a record AUD 1.06 billion as of September 30, 2025. Nevertheless, the company is stronger than ever before in terms of operations. The September 2025 quarter set a new record with revenue of AUD 200 million, demonstrating that the strategy of becoming independent from China is bearing fruit.

Lynas has also published a strategy for the coming years (“Towards 2030”). According to this, Malaysia will remain the main hub for separation, but will be modernized technologically. In the US (Texas), despite some delays, the plan to build a heavy rare earths plant is still on track. Support is coming from the US Department of War. In Australia, Kalgoorlie will take over the chemically “dirty” part of the process in order to reduce regulatory risks in Malaysia. Due to the strong cash position, acquisitions are possible. Lynas is actively looking for smaller explorers to broaden its raw material base. We consider targets in Brazil or Africa to be realistic. In principle, there are no other attractive deposits anywhere else, or they are unsellable for political reasons. The stock had doubled at its peak in 2025, only to halve again. Lynas is the most advanced and stable Western company in the rare earths market.

MP Materials: The shooting star from the US

MP Materials (MP | NYSE) is the shooting star of the scene. The US company was actually a sleepy dwarf that no one was interested in. But in 2025, its market value rose to around USD 20 billion at times. It is now still worth USD 12.5 billion. Considering that the market volume for 2032 is estimated at around USD 8 billion, that is a lot of money. In any case, most of the speculative money went into this stock. However, MP Materials is also the only relevant producer with production in the US. MP has been developing the prestigious Mountain Pass Mine for more than a decade. The goal is to “bring production back to the US.” They are developing their own facilities for the production of Neodymium-iron-boron magnets (NdFeB). MP Materials is directly supported by the US Department of War and is expected to increase production massively. In addition, purchase agreements have already been signed with US corporations such as General Motors. Last but not least, Apple has agreed to a $500 million cooperation with MP. The iPhone company also wants to secure its material and cooperate with MP on processing technology.

However, it is also clear that the expansion plans are ambitious and expensive. MP Materials is pursuing an ambitious three-stage plan (Stages I-III) for the Mountain Pass Mine in California to establish the first fully integrated rare earth supply chain in the US. In the first phase, concentrate production was optimized. Mountain Pass is currently already producing at record levels (approx. 45,000 tons of REO in 2024/25). This means that the mine covers around 15 percent of the global demand for rare earth concentrates. In the second phase, the aim is to separate the concentrate into high-purity oxides on site instead of shipping it to China for processing. In addition, there are plans to build a new plant for separating heavy rare earths (supported by a USD 150 million loan from the Pentagon). The goal is to produce approximately 200 tons of Dysprosium (Dy) and Terbium (Tb) per year. Commissioning is planned for mid-2026. Since the third quarter of 2025, MP Materials has officially stopped exporting concentrates to China and is now increasingly processing the material itself. In addition, the third phase will see the move to the finished end product. MP wants to sell not only metals, but also finished magnets. To this end, the Independence plant is being built in Fort Worth, Texas. Commercial production of the first magnets is scheduled to begin in early 2026. The goal is to produce around 1,000 tons of magnets per year, which would be enough for approximately 500,000 electric car motors, for example. In July 2025, MP announced a partnership with the US Department of War to build a second, even larger magnet factory. This is expected to increase capacity to a total of 10,000 tons by 2028. A key factor in the success of these investments is an agreement with the US Department of War that came into force in October 2025. It guarantees MP Materials a minimum price of US$110 per kilogram for NdPr oxide. Of all four stocks, we currently consider MP Materials to be by far the most expensive. However, it must also be said that they own the only mine in the US and currently have the capital to build an independent supply chain. Furthermore, there is likely to be little competition.

St George Mining: Two opportunities!

St George Mining (SGQ | ASX) has something in common with the other two Australian companies: commodity billionaire Gina Reinhart has also invested in it. In the fall, the company raised AUD 72.5 million from investors. AUD 22.5 million came from Reinhart. The funds will finance St George Mining until a decision is made on the mine construction. The company is developing the Araxá project in Brazil. It plans to start mining the critical metal Niobium in just two years. A year later, production of rare earths is to begin. In 2025, the company presented its first JORC-compliant resource estimate. According to this, there are 41.2 million tons with an average of 0.68% Niobium pentoxide and 40.6 million tons with 4.13% rare earths. In terms of rare earths, the deposit has similarly high grades to Chinese deposits. According to management, the deposit contains six of the ten most important rare earth metals. One advantage that the company emphasizes is that almost the entire deposit is located within the upper 100 meters and thus directly on the surface. This would keep production costs low for the planned open-pit development. In addition, work is underway to expand the resource.

What makes this special is that Niobium is not a rare earth metal, but there is still a quasi-monopoly here. This is because the private Brazilian company CBMM controls around 80 percent of the global market. It operates its largest mine right next to the St George Mining deposit. As Chinese companies already hold minority stakes in CBMM, St George Mining is also in a sweet spot. The management’s next goals are to update and expand the existing resource as a result of the ongoing drilling program. In addition, the economic feasibility of the project is to be demonstrated by means of a scoping study. Both are to be completed by the end of the first quarter of 2026.

Furthermore, the company’s partnership with the US group REAlloys should not be underestimated. REAlloys produces high-performance magnetic materials made of Neodymium-iron-boron (NdFeB) and Samarium-cobalt (SmCo) for US government organizations, including the Defense Logistics Agency (DLA) and the AMES National Laboratory (AMES) of the US Department of Energy. It also works for US industrial companies in the defense, aerospace, and electronics sectors. Accordingly, St George Mining could participate in the rare earth boom in the United States.

St George Mining’s market capitalization currently stands at around AUD 365 million. The stock had temporarily increased eightfold in 2025 and then fell back like its competitors. Analysts at Petra Capital see a price target of AUD 0.44. In its first study, investment bank Macquarie gives an “outperform” rating and a price target of AUD 0.20. Both targets are well above the current share price. We like the fact that St George Mining aims to start producing niobium in 2028 and rare earths a year later, which could lead to a re-rating of the stock in the foreseeable future.

This could also be interesting for you: Gold at an all-time high: Four Opportunities for 2026!

Disclaimer: the German-language version applies (see below).The author holds shares in St George Mining. Please refer to our disclaimer. You can find a German version of this article here.

Das könnte Sie auch interessieren:

- Zwei Energieaktien für 2026: 2G Energy & Condor Energies

- Seltene Erden: Diese vier Aktien stehen im Fokus!

- Fortinet: Die unterschätzte Cybersecurity-Aktie

- Bringen Chinas neue Exportkontrollen den nächsten Schub?

- Was ist eigentlich der “Debasement Trade”?

- Goldaktien: Unsere Favoriten für 2026

- Rüstungs-Ranking: Rheinmetall steigt in globale Top-20 auf!

- IBM-Chef schlägt Alarm: KI-Wette kann nicht aufgehen!

- Kupfer: Der Mangel ist schon da!

- Silber: Das missverstandene Edelmetall!

- Alphabet: Gefährden die TPU-Chips die Gewinne von NVIDIA?

- Im Goldrausch: Quimbaya Gold bestätigt Bohrthese neben Aris Mining und sichert Finanzierung

- Elektroautos: Tesla sieht derzeit nur die Rücklichter von VW und BYD!

- Platzt die OpenAI-Blase? HSBC sieht riesiges Finanzierungsloch!

- Meta: Das erste Opfer des KI-Booms?

- Hindenburg-Omen: Crash-Signal oder überbewertet?

- Mineros: Goldminer auf Wachstumskurs

- Antimon: Das Metall, nach dem sich die Großmächte sehnen!

- M&A im Rohstoffmarkt 2024: Meiste Übernahmen bei Gold-Aktien

- PTX Metals: Investoren blicken wieder auf Explorer!

- Triple Flag: Der Royalty-Gewinner

- Sigma LIthium: Eine Wette auf die Wende am Lithium-Markt!

- Uranium Energy: Zweite Chance für Nachzügler?

- Condor Energies: Interview mit CEO Don Streu!

- Canadian Natural Resources: Die beste Ölaktie der Welt?

- Enapter: Iridium-frei Elektrolyse – Der entscheidende Wettbewerbsvorteil?

- Ero Copper: Auf den Kupferpreis setzen!

- Orecap Invest: Kleiner, aber feiner Dealmaker in der Rohstoffbranche!

- Perpetua Resources: Goldmine mit stratgeischem Interesse der USA!

- Zum Tod von Charlie Munger: Seine besten Sprüche und Lebensweisheiten!

- Ranking: die meistverkauften Spielekonsolen aller Zeiten!

_____________________________________________________________________________________

DISCLAIMER. BITTE UNBEDINGT BEACHTEN!

Hinweis auf mögliche Interessenskonflikte gemäß Paragraph 34 WpHG i.V.m. FinAnV: Mitarbeiter, Berater und freie Redakteure von www.investor-magazin.de können jederzeit Aktien an allen vorgestellten Unternehmen halten, kaufen oder verkaufen. Das gilt ebenso für abgeleitete Finanzinstrumente, Kryptowährungen oder Rohstoffe. Sollte ein Mitarbeiter, Berater oder freier Redakteur zum Zeitpunkt der Veröffentlichung eines der hier genannten Wertpapiere besitzen, wird dies an dieser Stelle genannt. Der Autor besitzt folgende der im Artikel genannten Aktien oder Finanzprodukte: St George Mining. Hinweis auf Interessenkonflikte: Es besteht eine entgeltliche Auftragsbeziehung zwischen dem Herausgeber und einem im Text vorgestellten Unternehmen (St George Mining). Daher besteht hier ein eindeutiger Interessenkonflikt.

Zudem weisen wir gerne auf die Broschüren der BaFin zum Schutz vor unseriösen Angeboten hin:

– Geldanlage – Wie Sie unseriöse Anbieter erkennen (pdf/113 KB)

– Wertpapiergeschäfte – Was Sie als Anleger beachten sollten (pdf/326 KB)

Risikohinweis: Wir weisen darauf hin, dass der Erwerb von Wertpapieren jeglicher Art hohe Risiken birgt, die zum Totalverlust des eingesetzten Kapitals führen können – oder darüber hinaus. Jegliche auf dieser Webseite verbreiteten Artikel rufen explizit nicht zum Kauf oder Verkauf von Wertpapieren auf. Es kommt weder eine Anlageberatung noch ein Anlagevermittlungsvertrag mit dem Leser zustande. Die hier dargestellten Informationen beziehen sich auf das Unternehmen oder den Markt und nicht auf die persönliche Situation des Lesers. Grundsätzlich möchten wir Ihnen Ideen für unseres Erachtens aussichtsreiche Investments geben. Bitte passen Sie diese dann an Ihre individuelle Strategie und persönliche Finanzsituation an. Und bitte vergessen Sie nicht: Wir haben keine Glaskugel, wir haben aber viel Erfahrung und Wissen. Daher raten wir stets dazu, dass Sie als Leser Ihren Kopf benutzen und Ihre eigenen Analysen erstellen sollten: Do your own Due Dilligence!

Datenschutz: Wir geben Ihre Daten nicht an externe Dritte weiter. Aufgrund der neuen Datenschutz Grundverordnung haben wir unsere Datenschutzerklärung aktualisiert.

Keine Haftung für Links: Mit Urteil vom 12. Mai 1998 hat das Landgericht Hamburg entschieden, dass man durch die Ausbringung eines Links die Inhalte der verlinkten Seiten ggf. mit zu verantworten hat. Dies kann nur dadurch verhindert werden, dass man sich ausdrücklich von diesem Inhalt distanziert. Für alle Links auf dieser Webseite gilt: Der Betreiber distanziert sich hiermit ausdrücklich von allen Inhalten aller verlinkten Seiten und macht sich diese Inhalte nicht zu Eigen.

Keine Finanzanalyse: Der Herausgeber weist ausdrücklich darauf hin, dass es sich bei den Besprechungen um keine Finanzanalysen nach deutschem Kapitalmarktrecht handelt, sondern um journalistische und/oder werbliche Texte. Sie erfüllen deshalb nicht die Anforderungen zur Gewährleistung der Objektivität von Anlageempfehlungen. Bitte beachten Sie außerdem: Die Nutzung dieses Informationsangebots ist ausschließlich Personen vorbehalten, die ihren dauerhaften Wohnsitz in der Bundesrepublik Deutschland haben.

Urheberrecht: Der Inhalt und die Struktur dieser Webseite sind urheberrechtlich geschützt und Eigentum des Betreibers. Sie dürfen nicht ohne vorherige schriftliche Zustimmung weder verwendet noch reproduziert werden, auch nicht auszugsweise. Der Betreiber ist bestrebt, in allen seinen Publikationen die Urheberrechte der verwendeten Grafiken, Bilder und Texte zu beachten. Allein aufgrund der bloßen Nennung oder Nichtnennung von Rechten Dritter ist nicht der Schluss zu ziehen, dass diese nicht geschützt sind! Sollte der Betreiber dennoch gegen Rechte Dritter verstoßen haben, wird er unter dem Vorbehalt der Prüfung unverzüglich jegliche Dateien entfernen, sofern er auf die Rechtsverletzung schriftlich hingewiesen wurde.

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr