Graphite, Lithium and Uranium are already popular topics among investors. The situation with Helium is just as threatening. Due to the high demand from the high-tech sectors, there is a threat of a shortage in supply. The small producer Royal Helium could profit from these developments.

Helium: a noble gas with an interesting history

Helium is number two in the periodic table of chemical elements after hydrogen and was first discovered in 1868 by the French astronomer Jules Janssen. At the Zeppelin Museum near Frankfurt, Germany, you can learn about the historical significance of this gas, which is widespread in space but quite rare on Earth. Helium became known in the course of an accident: On May 6, 1937, the German airship Hindenburg, filled with hydrogen, exploded in Lakehurst (USA). Non-flammable Helium would have been a safe alternative as a lifting gas for airships. But the USA, as the world’s only producer at the time, had banned exports to Germany.

Helium is traditionally produced in commercially viable quantities during the extraction of natural gas. In the early 20th century, large quantities of helium were found in natural gas fields in the Great Plains. This made the USA the leading and, for a long time, the only world supplier of helium.

Today, helium is mainly in demand as a coolant

Today, there are practically no more airships, at least not on a large, commercial scale. Helium, on the other hand, is used today primarily as a coolant. In its liquid state, it is an indispensable tool for reaching the lowest temperatures. It is the only substance that does not turn to ice even at -273 °C under normal pressure. Helium has a wide range of applications, many of which are known only to experts: It is used in medical devices and to cool the infrared detectors of space telescopes, as a coolant for superconducting magnets, in deep-sea breathing apparatus, as a shielding gas for industrial applications (for example, in metal arc welding and in the production of silicon wafers). The aerospace industry has the largest demand in quantitative terms, at 38%. Liquid Helium is used, among other things, as a coolant for oxygen-hydrogen rocket fuels, but is also needed for guidance systems and radar equipment. With growing consumption and increasing scarcity, the noble gas is also becoming interesting for investors.

In the ups and downs of supply and demand

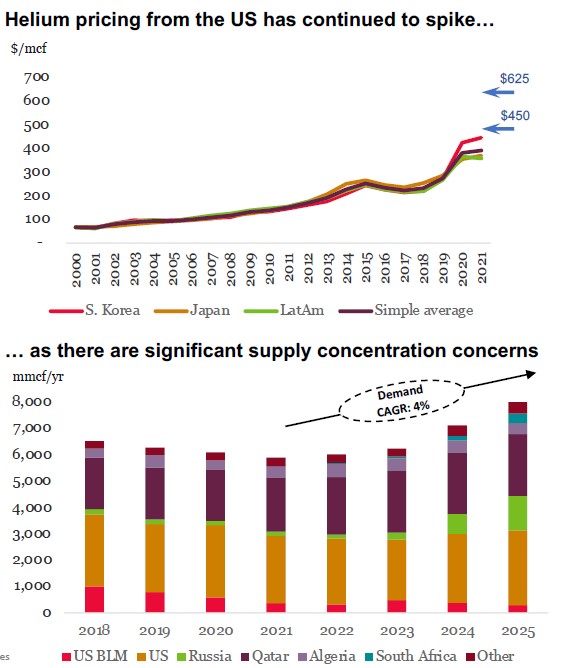

The market for Helium is not very transparent, and is also dependent on politics. The U.S. government had the National Helium Reserve built in Amarillo, Texas, in 1925. Despite fluctuating demand, the facility has been greatly expanded. In 2004, about ten times the world’s annual demand was stored there – despite the Clinton administration’s Helium Privatization Act of 1996, which required this formerly strategic reserve to be dissolved. This act triggered a Helium glut with a sharp drop in prices. However, because consumption is constantly rising, analysts keep warning of shortages. They point out that only some natural gas deposits are suitable for producing helium. The reserves built up by the U.S. government have also been largely depleted. The European Union did remove Helium from its list of critical raw materials. Nevertheless, the price doubled in 2022 as demand significantly exceeded supply.

Royal Helium, a new producer in Canada

Profiting from the Helium boom as an investor is not easy. For natural gas producers, it’s just an unimportant byproduct. The marketing of Helium is in the hands of large corporations such as Linde, Air Products & Chemicals or DuPont. For them, however, it is only a small part of their sales.

There are about half a dozen Helium juniors, some of which have attracted attention with PR campaigns. To us, Royal Helium (0.33 C$ | RHC.v) seems interesting. The company specializes in exploiting deposits that contain carbon dioxide and nitrogen instead of natural gas, in addition to Helium. This is considered more environmentally friendly and is also manageable on a smaller scale.

Follow us on Twitter

Royal Helium: production start-up imminent

Royal Helium is about to start production. It has secured huge trlacts of land in the Canadian provinces of Saskatchewan and Alberta to expand production in the coming years. The gas will be upgraded to 99.999% purity on site by Royal Helium, which will also market it itself. The largest target market is aerospace – the sector with the highest growth rates. Royal Helium has signed offtake agreements with a private space company in August 2022 and May 2023 – at 450 and 625 US dollars/mcf (US dollar per 1000 cubic feet) respectively. This is well above the current market price. Production at the company’s first helium project, Steveville in Alberta, is thus sold out even before production begins.

The extraction of helium is similar to that of natural gas. A hole is drilled and the helium trapped under a layer of rock, created millions of years ago by a radioactive decay process, is pumped out together with the other gases present there. Some of the helium in Steveville is less than half a percent. Arjae Design Solutions, an Alberta company, is building a plant on the site that will separate the Helium from the other gases and bring it to the desired purity level of 99.999%. The resulting carbon dioxide is sold as a byproduct, and the nitrogen, which is not harmful to the climate, is blown into the atmosphere.

Delays in the construction of the processing plant

Construction of this plant was repeatedly delayed after the contract was awarded in October 2022. The start of production scheduled for the first half of 2023 could not be met because parts were not completed in time. On June 14, Royal Helium reported that the first modules had been transported to the Steveville site. The rest are expected to be shipped in the next few weeks. Construction is already fully funded through equity and loans.

Atypical short payback time

At 22 million cubic feet (equivalent to 623,000 cubic meters), Steveville will produce just one-thousandth of the world’s annual helium consumption. This is in addition to 20 million pounds of carbon dioxide per year. Royal Helium expects to recoup the capital outlay for the Steveville project in as little as one year by marketing these two gases. Helium reserves at the site should last nine years. The processing plant has a life of 25 years. A small project, but quite profitable. And the starting point for further growth: in its “base case scenario,” Royal Helium wants to use its extensive properties to increase production to 311 million cubic feet (8.8 million cubic meters) per year by 2030, which would represent 30-40% of Canada’s helium supply that year.

Good positioning compared to other start-ups

Conclusion: Canada does not currently play a major role as a Helium supplier. The country is far behind the USA, Qatar and Algeria, the three most important suppliers at present. This is expected to change in the coming years: the geological resources are available, and there is no lack of government support. U.S. production, on the other hand, is stagnating or even declining slightly. Royal Helium is touting itself as one of the few new suppliers from a politically safe country – unlike Russia, Qatar, Algeria and Senegal, where Helium is a waste product when natural gas is cooled down for transport as LNG.

Compared to other publicly traded startups such as Desert Mountain Energy, Total Helium and Avanti Energy, Royal Helium is ahead in two ways: it is no longer an exploration company, but is about to start production. With 862,908 acres of land in Saskatchewan alone, it has immense development opportunities – despite low Helium concentrations of 0.33% to 0.64%. North American investor portal Wealth Awsome assesses that: “Considering how much land Royal Helium has, with cost-effective mining and processing, the company can produce much more helium than competitors with smaller but helium-rich resources.”

From a risk perspective, the share can perhaps be compared to that of a mining company commissioning its first gold mine. Here, too, success is not guaranteed and delays can postpone the most attractive cash flow plans into the future or make them obsolete. However, North American Helium has shown that such an undertaking can also work well. The company owns 9.1 million acres of land in Canada and just brought its sixth helium production plant into production. It is the most active helium driller in Canada and has solid finances despite breathtaking growth. Of course, this company also has one drawback: it is not publicly traded.

Please note: Investments in the capital markets are associated with a high level of risk. Investors can lose all of their capital – and more. Remember to do your own due diligence! The content of this website is intended exclusively for readers who are permanent residents of Germany. The German disclaimer applies (see below).

You might also be interested in…

– Marathon Gold: The next gold mine in Newfoundland!

– Ranking: The most innovative Companies in the World

– Tourmaline Oil: Betting on a higher natural gas price

– Banyan Gold: New Gold rush in the Yukon!

– DHT Holdings: Tankers as cash machines

– Ranking: The largest Copper-Mines in the World!

– Xortx Therapeutics: Now it’s time for the final spurt!

– Delignit: Back on track!

– Beaconsmind: Digital solutions for store-based business

– Nippon Sanso: Moat und catch-up potential

– Ero Copper: A copper producer that hardly anyone knows

– Obsidian Energy: The big One among the smaller Oil-Producers

– Ranking: Best selling Gaming consoles in the World!

– Net Digital: A German payment service provider with AI!

Graphics: Das Investor Magazin, Royal Helium, BML, AKAP Energy, H&P Research

_____________________________________________________________________________________

DISCLAIMER. BITTE UNBEDINGT BEACHTEN!

Grundsätzlicher Hinweis auf mögliche Interessenskonflikte gemäß Paragraph 34 WpHG i.V.m. FinAnV: Mitarbeiter, Berater und freie Redakteure von www.investor-magazin.de können jederzeit Aktien an allen vorgestellten Unternehmen halten, kaufen oder verkaufen. Das gilt ebenso für abgeleitete Finanzinstrumente. Sollte dies der Fall sein, wird dies an dieser Stelle genannt. Der Autor hält Aktien von Canadian Natural Resources.

Zudem weisen wir gerne auf die Broschüren der BaFin zum Schutz vor unseriösen Angeboten hin:

– Geldanlage – Wie Sie unseriöse Anbieter erkennen (pdf/113 KB)

– Wertpapiergeschäfte – Was Sie als Anleger beachten sollten (pdf/326 KB)

Risikohinweis: Wir weisen darauf hin, dass der Erwerb von Wertpapieren jeglicher Art hohe Risiken birgt, die zum Totalverlust des eingesetzten Kapitals führen können – oder darüber hinaus. Jegliche auf dieser Webseite verbreiteten Artikel rufen explizit nicht zum Kauf oder Verkauf von Wertpapieren auf. Es kommt weder eine Anlageberatung noch ein Anlagevermittlungsvertrag mit dem Leser zustande. Die hier dargestellten Informationen beziehen sich auf das Unternehmen und nicht auf die persönliche Situation des Lesers. Grundsätzlich möchten wir Ihnen Ideen für unseres Erachtens aussichtsreiche Investments geben. Bitte passen Sie diese dann an Ihre individuelle Strategie und persönliche Finanzsituation an. Und bitte vergessen Sie nicht: Wir haben keine Glaskugel, wir haben aber viel Erfahrung und Wissen. Daher raten wir stets dazu, dass Sie als Leser ihre eigenen Analysen vornehmen. Do your own Due Dilligence!

Datenschutz: Wir geben Ihre Daten nicht an externe Dritte weiter. Aufgrund der neuen Datenschutz Grundverordnung haben wir unsere Datenschutzerklärung aktualisiert. Sie können sich für unseren kostenlosen Newsletter hier anmelden. Eine Abmeldung ist jederzeit per Mail an info (at) investor-magazin.de möglich.

Keine Haftung für Links: Mit Urteil vom 12.Mai 1998 hat das Landgericht Hamburg entschieden, dass man durch die Ausbringung eines Links die Inhalte der verlinkten Seiten ggf. mit zu verantworten hat. Dies kann nur dadurch verhindert werden, dass man sich ausdrücklich von diesem Inhalt distanziert. Für alle Links auf dieser Webseite gilt: Der Betreiber distanziert sich hiermit ausdrücklich von allen Inhalten aller verlinkten Seiten und macht sich diese Inhalte nicht zu Eigen.

Keine Finanzanalyse: Der Herausgeber weist ausdrücklich darauf hin, dass es sich bei den Besprechungen um keine Finanzanalysen nach deutschem Kapitalmarktrecht handelt, sondern um journalistische und/oder werbliche Texte. Sie erfüllen deshalb nicht die Anforderungen zur Gewährleistung der Objektivität von Anlageempfehlungen. Bitte beachten Sie außerdem: Die Nutzung dieses Informationsangebots ist ausschließlich natürlichen Personen vorbehalten, die ihren dauerhaften Wohnsitz in der Bundesrepublik Deutschland haben. Allen anderen natürlichen oder juristischen Personen oder Personengruppen ist die Nutzung wie auch der Zugang zu dieser Webseite nicht gestattet.

Urheberrecht: Der Inhalt und die Struktur dieser Webseite sind urheberrechtlich geschützt und Eigentum des Betreibers. Sie dürfen nicht ohne vorherige schriftliche Zustimmung weder verwendet noch reproduziert werden, auch nicht auszugsweise. Der Betreiber ist bestrebt, in allen seinen Publikationen die Urheberrechte der verwendeten Grafiken, Bilder und Texte zu beachten. Allein aufgrund der bloßen Nennung oder Nichtnennung von Rechten Dritter ist nicht der Schluss zu ziehen, dass diese nicht geschützt sind! Sollte der Betreiber dennoch gegen Rechte Dritter verstoßen haben, wird er unter dem Vorbehalt der Prüfung unverzüglich jegliche Dateien entfernen, sofern er auf die Rechtsverletzung schriftlich hingewiesen wurde.

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr