The stock of Pan American Silver, the “world’s leading silver producer,” is considered severely undervalued and a potential runaway winner when precious metals prices rise. Is the stock already a buy and how did it fare in previous gold and silver rallies? Our analysis.

Pan American: More gold than silver!

Pan American Silver ($PAAS) was founded over 25 years ago by the now legendary Ross Beaty and is now one of the established names in the mining business. The company brings around 5.7 billion US$ to the stock exchange scales. Through the takeover of Yamana Gold‘s Latin American activities, which was completed at the end of March, silver production has increased by 55 percent, while gold production has more than doubled. Pan American Silver – like all its major competitors – is now more of a gold company, despite the “silver” in its name. In 2023, 21 to 23 million ounces of silver and 870,000 to 970,000 ounces of gold are to be produced. Taking the respective average of these forecasts, silver worth $506 million and gold worth $1.775 billion will be mined this year. This calculation assumes a silver price of US$23 per ounce and a gold price of US$1,930 per ounce.

The reorientation from silver to gold of many former “silver companies” is easy to understand. At a gold price of US$1,500/ounce, most are still making money. At silver prices below 20 US dollars/ounce, on the other hand, the companies are threatened with bankruptcy. Of course, the same calculation works the other way around: the profit of a metal producer with a high silver content increases disproportionately when the silver price rises sharply.

Spectacular gains and losses

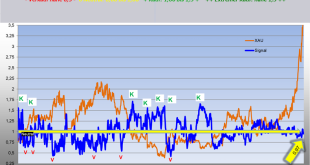

For a long-term investor in the precious metals sector, the royalty company Franco-Nevada has been the ideal stock over the past twenty years. The stock slightly lagged the market in bull market phases, but hardly fell during the bear markets, which often lasted several years. Pan American Silver, on the other hand, is not a stock that can be bought and then forgotten (see chart above). It has been tops in gold and silver in uptrends, and has lost disproportionately in bad times.

Follow us on Twitter!

The phases of bull market and bear market can be easily seen on the chart. From 2001 to 2008, the share price increased more than tenfold from $3 to $40. From February to August 2016, the price of silver rose 37%, and Pan American Silver gained a whopping 200%. After the Corona crash in 2020, the price of silver doubled from extremely low levels in a few months, with Pan American Silver up 175%. But this also worked in the opposite direction: over the past three years, the price of silver has declined 15%, and Pan American Silver’s stock has more than halved. So whether this stock is a good or bad investment depends to a large extent on the development of metal prices.

Lowly valued compared to competitors

Fundamentally, Pan American Silver is valued low. Following the Yamana acquisition, the company operates ten mining operations in Latin America (Mexico, Peru, Bolivia, Brazil, Argentina, Chile) and one in Canada. The 56.25% interest in the Mara project under development in Argentina included in the Yamana portfolio was sold for $475 million in cash and a 0.75% copper NSR royalty. In addition, some smaller assets were divested for a combined $120 million. The figures for the second quarter, the first after the acquisition of Yamana’s mines, were better than expected by many observers.

Pan American now has three mines, each with about 180,000 ounces of gold equivalent annual production (Jacobina in Brazil, Cerro Moro in Argentina, El Penon in Chile). This concentration of production resulted in better margins. Silver costs decreased from US$17.30/ounce to US$15.70/ounce, and gold costs decreased from an excessively high US$2,051/ounce to an acceptable US$1,342/ounce (AISC). Revenue grew 88% year-over-year to $639.9 million, and operating cash flow was $117 million (Q2 2022: $20.8 million).

Growth profile becomes clear!

Despite these good results, Pan American Silver’s price/cash flow ratio is below that of competitors of much lower quality, such as First Majestic or Hecla Mining. Compared to how Pan American Silver was previously valued, the stock is downright dirt cheap. With the Jacobina and Cerro Moro expansion and work on the massive Colorado Skarn project, Pan American Silver has the best growth profile compared to its peers. The dividend yield is currently around 2.6%.

Escobal mine in Guatemala a nuisance and a wild card

If Pan American Silver succeeds in restarting the Escobal mine in Guatemala, acquired in 2018 through the acquisition of Tahoe Resources and already shut down the year before, it would be an additional driver: silver production would almost double from about 22 million ounces to about 38 million ounces per year. Whether this will actually happen is difficult to judge from our position. Pan American Silver’s optimism on the matter is part of the business. If it were to reopen, Escobal would be one of the largest and most profitable silver mines in the world.

The history of the mine, located in southern Guatemala, accompanied by lawbreaking, murder and state violence, can be traced quite well. Goldcorp (now part of Newmont) began exploration in 2007, but offloaded the project to Tahoe Resources in 2011. In April 2013, the mine received a 25-year operating permit from the Guatemalan central government, despite strong protests from local residents. This was illegal, but also unsurprising in one of the most corrupt countries on earth. The mine, with its gigantic dimensions, is located on the land of the indigenous Xinka people. However, the rights of Guatemala’s indigenous peoples are protected under a 1995 law, and the mine should not have been approved without the consent of the local parliament. The local population of the nearby small town of Las Flores (population 4,000) blocked access roads to the mine, and several Xinka were abducted or killed in large-scale police and military operations. In 2017, Guatemala’s Constitutional Court finally ordered that the mine remain closed until a settlement was reached. The following year, the mine fell into Pan American Silver’s portfolio through its acquisition of Tahoe.

Opponents and supporters of the Escobal mine

Pan American Silver hopes that Guatemala’s Supreme Court will lift the operating ban on the mine because, from the company’s point of view, the consultations with the local population required by the court have taken place as requested. Opponents, in turn, are demanding its permanent closure. In August, a new president was elected in Guatemala, the social democrat Bernardo Arévalo. His main concern is to fight corruption. It remains to be seen whether this is relevant to these disputes. From a shareholder’s point of view, the reopening of the Escobal mine would of course be positive. However, it should not be firmly planned for.

Conclusion: Historically and also compared to competitors, Pan American Silver’s stock is very favorably valued. And even without the controversial activities in Guatemala, this is an attractive company that will benefit from the acquisition of Yamana’s mines in Latin America. If precious metal prices rise, the leverage from the stock should be tremendous, as the historical ups and downs show. If so, the stock will be one of the favorites among precious metals producers.

Please note: Investments in the capital markets are associated with a high level of risk. Investors can lose all of their capital – and more. Remember to do your own due diligence! The content of this website is intended exclusively for readers who are permanent residents of Germany. The German disclaimer applies (see below).

You might also be interested in…

- PNE Wind: A second chance for investors?

- Nvidia: Demolished expectations!

- Apple: Buy the dip?

- Artemis Gold: This share travels under the Radar!

- Exasol: Still waiting for the turnaround!

- Redcare Pharmacy shows strong growth!

- Covestro: Adnoc increases takeover bid!

- Royal Helium: Noble Gases for the Space Industry!

- Marathon Gold: The next gold mine in Newfoundland!

- Ranking: The most innovative Companies in the World

- Tourmaline Oil: Betting on a higher natural gas price

- Banyan Gold: New Gold rush in the Yukon!

- DHT Holdings: Tankers as cash machine!

- Ranking: The largest Copper-Mines in the World!

- Xortx Therapeutics: Now it’s time for the final spurt!

- Delignit: Back on track!

- Beaconsmind: Digital solutions for store-based business

- Nippon Sanso: Moat und catch-up potential

- Ero Copper: A copper producer that hardly anyone knows

- Obsidian Energy: The big One among the smaller Oil-Producers

- Ranking: Best selling Gaming consoles in the World!

- Net Digital: A German payment service provider with AI!

Graphics: Das Investor Magazin, Pixabay, Pan American Silver

_____________________________________________________________________________________

DISCLAIMER. BITTE UNBEDINGT BEACHTEN!

Grundsätzlicher Hinweis auf mögliche Interessenskonflikte gemäß Paragraph 34 WpHG i.V.m. FinAnV: Mitarbeiter, Berater und freie Redakteure von www.investor-magazin.de können jederzeit Aktien an allen vorgestellten Unternehmen halten, kaufen oder verkaufen. Das gilt ebenso für abgeleitete Finanzinstrumente. Sollte dies der Fall sein, wird dies an dieser Stelle genannt.

Zudem weisen wir gerne auf die Broschüren der BaFin zum Schutz vor unseriösen Angeboten hin:

– Geldanlage – Wie Sie unseriöse Anbieter erkennen (pdf/113 KB)

– Wertpapiergeschäfte – Was Sie als Anleger beachten sollten (pdf/326 KB)

Risikohinweis: Wir weisen darauf hin, dass der Erwerb von Wertpapieren jeglicher Art hohe Risiken birgt, die zum Totalverlust des eingesetzten Kapitals führen können – oder darüber hinaus. Jegliche auf dieser Webseite verbreiteten Artikel rufen explizit nicht zum Kauf oder Verkauf von Wertpapieren auf. Es kommt weder eine Anlageberatung noch ein Anlagevermittlungsvertrag mit dem Leser zustande. Die hier dargestellten Informationen beziehen sich auf das Unternehmen und nicht auf die persönliche Situation des Lesers. Grundsätzlich möchten wir Ihnen Ideen für unseres Erachtens aussichtsreiche Investments geben. Bitte passen Sie diese dann an Ihre individuelle Strategie und persönliche Finanzsituation an. Und bitte vergessen Sie nicht: Wir haben keine Glaskugel, wir haben aber viel Erfahrung und Wissen. Daher raten wir stets dazu, dass Sie als Leser ihre eigenen Analysen vornehmen. Do your own Due Dilligence!

Datenschutz: Wir geben Ihre Daten nicht an externe Dritte weiter. Aufgrund der neuen Datenschutz Grundverordnung haben wir unsere Datenschutzerklärung aktualisiert. Sie können sich für unseren kostenlosen Newsletter hier anmelden. Eine Abmeldung ist jederzeit per Mail an info (at) investor-magazin.de möglich.

Keine Haftung für Links: Mit Urteil vom 12.Mai 1998 hat das Landgericht Hamburg entschieden, dass man durch die Ausbringung eines Links die Inhalte der verlinkten Seiten ggf. mit zu verantworten hat. Dies kann nur dadurch verhindert werden, dass man sich ausdrücklich von diesem Inhalt distanziert. Für alle Links auf dieser Webseite gilt: Der Betreiber distanziert sich hiermit ausdrücklich von allen Inhalten aller verlinkten Seiten und macht sich diese Inhalte nicht zu Eigen.

Keine Finanzanalyse: Der Herausgeber weist ausdrücklich darauf hin, dass es sich bei den Besprechungen um keine Finanzanalysen nach deutschem Kapitalmarktrecht handelt, sondern um journalistische und/oder werbliche Texte. Sie erfüllen deshalb nicht die Anforderungen zur Gewährleistung der Objektivität von Anlageempfehlungen. Bitte beachten Sie außerdem: Die Nutzung dieses Informationsangebots ist ausschließlich natürlichen Personen vorbehalten, die ihren dauerhaften Wohnsitz in der Bundesrepublik Deutschland haben. Allen anderen natürlichen oder juristischen Personen oder Personengruppen ist die Nutzung wie auch der Zugang zu dieser Webseite nicht gestattet.

Urheberrecht: Der Inhalt und die Struktur dieser Webseite sind urheberrechtlich geschützt und Eigentum des Betreibers. Sie dürfen nicht ohne vorherige schriftliche Zustimmung weder verwendet noch reproduziert werden, auch nicht auszugsweise. Der Betreiber ist bestrebt, in allen seinen Publikationen die Urheberrechte der verwendeten Grafiken, Bilder und Texte zu beachten. Allein aufgrund der bloßen Nennung oder Nichtnennung von Rechten Dritter ist nicht der Schluss zu ziehen, dass diese nicht geschützt sind! Sollte der Betreiber dennoch gegen Rechte Dritter verstoßen haben, wird er unter dem Vorbehalt der Prüfung unverzüglich jegliche Dateien entfernen, sofern er auf die Rechtsverletzung schriftlich hingewiesen wurde.

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr