Artemis Gold is currently building one of Canada’s largest gold mines, and hardly anyone is noticing. At the same time, the company will have low costs and high cash flows. The share offers a moderate valuation and thus potential for long-term investors.

Barely any presence on the World Wide Web

Judging by its weak presence on YouTube or its low follower count on the well-known U.S. investor portal Seeking Alpha as a benchmark, Artemis Gold ($5.40 CAD | ARTG) is virtually non-existent. The company would have deserved more attention, because it is currently building one of Canada’s largest gold mines. In addition, the stock market value amounts to one billion Canadian dollars. The price potential on a 12 to 18 month horizon is above average.

Management is looking for a new task

Artemis Gold is – similar to SilverCrest Metals, Integra Resources or i-80 Gold – one of those successful spin-outs that were created as a “waste product” of a company takeover. The story is actually always the same: A junior mining company is swallowed up by a larger competitor. This usually leaves “leftovers” to be exploited. One of these “leftovers” is the often high-caliber management, well supplied with money but unemployed.

Like a goldfish eating a shark

In the case of Artemis, here’s how it went down: gold producer Atlantic Gold, active in the Canadian province of Nova Scotia, was swallowed by St Barbara in the summer of 2019 for $802 million. Management subsequently formed Artemis Gold, with Steven Dean as chairman and CEO. Prior to the IPO in late September 2019, there was a $32.6 million private placement. Then, in August 2020, something happened that looked to most observers like a goldfish eating a shark: Artemis Gold bought the Blackwater project in the province of British Columbia from New Gold – a mid-tier but relatively highly leveraged gold producer – for $190 million in cash, $15 million in treasury shares and an 8% gold stream.

With 8.2 million ounces of gold reserves and well advanced in the permitting process, Blackwater is a “world-class project.” There was one small problem, however: according to an old feasibility study, the mine is expected to cost $2 billion to build. Peter Arendas, commenting on the acquisition from New Gold’s perspective in 2020 on Seeking Alpha, put it this way, “Without question, this project is beyond New Gold’s capabilities. Ironically, it is even less feasible for Artemis Gold.” It was actually expected that New Gold would seek a financially strong partner for Blackwater. With some money in the bank and $65 million in market value, Artemis Gold was generally understood to be in no way the right candidate to take on such a mammoth project.

Capabilities underestimated

However, Artemis Gold’s management was underestimated in two respects:

- It has good contacts in the capital market and thus succeeded not only in raising the money to buy Blackwater, but also the estimated $730 to 750 million (US$: 645 million) costs for the first construction phase. Management and the board invested $201 million of their own money and now hold 38 percent of the stock. That’s another thing you don’t see every day on the stock market.

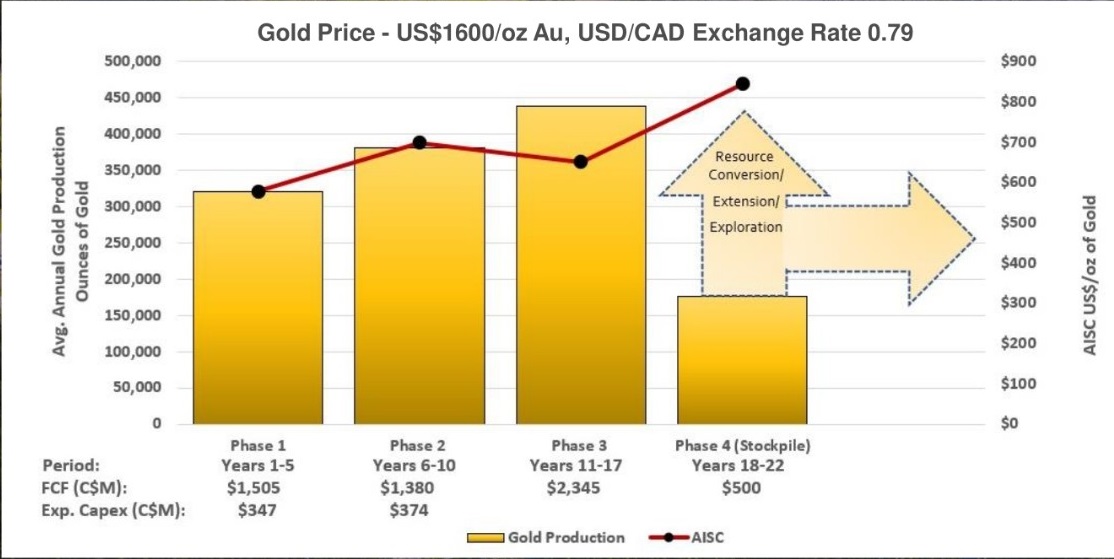

- The realization of this project, which was actually much too large, was made possible because it was possible to scale the construction of the mine. A CapEx of $645 million for a mine with a planned annual production of 321,000 ounces of gold in the first five years is extremely low. There are competitors spending much more on comparable projects. The free cash flows generated in phase 1 can then be used to finance phases 2 to 4. The mine life is already 22 years. A total of $1.418 billion is to be spent on mine construction, and average annual production in the first 17 years is expected to be over 400,000 ounces of gold.

Artemis Gold: Sensationally low mining costs

The ore is to be mined by open pit. The feasibility study sees costs in the first five years, when relatively high-grade material is mined at 1.62 grams of gold per ton, at a sensationally low US$578 per ounce (AISC). According to the company’s presentation, this would be the lowest value compared to 25 competitors. By comparison, major producers such as Barrick Gold or Newmont currently have AISC production costs of US$1,200 to US$1,300 per ounce. Based on the 22-year life of mine, the average gold grade is 0.75 grams per ton – an acceptable, though not outstanding, value for an open pit mine. Expected costs will slowly increase through mine life 22 (construction phases 2-4), but will still be well below those of most competitors. Assuming a gold price of US$1,600 per ounce, the mine is expected to generate C$1.505 billion in free cash flow in the first five years alone. This would recoup the costs of construction (phase 1) in 2.3 years. The mine is currently 20 percent complete (as of May 31, 2023). Production is scheduled to start in the second half of 2024. Plus point: There is a difference of more than 300 US dollars per ounce to the current gold price, so that the buffer is large if production costs are higher or the gold price falls back.

Wheaton Precious Metals as a partner

Wheaton Precious Metals management is confident in the success of this project. The company not only purchased the 8% gold stream from New Gold for $300 million, but invested an additional $181 million in the construction of the mine through other streaming agreements. WPM CEO Randy Smallwood said he was “impressed with the progress the Artemis Gold team has made in the permitting process and mine construction activities.” A “stream” is an agreement in which an investing company, such as Wheaton Precious Metals, acquires a percentage of a mine’s future production well below the market price in exchange for an upfront payment.

Artemis Gold: A promising stock

At 0.36 price/net asset value (NAV), Artemis Gold’s stock valuation is below the average of other mine developers (0.47). Haywood Capital Markets‘ analysts have rated the stock a “buy (high risk)”. The price target is C$9 (current price: C$ 5.40). The analyst did not discover any problems during a visit to the mine site (headline: “So far so good”).

A (nearly) doubling of the share price in the course of the next 12 to 18 months should be a quite realistic scenario if the valuation of comparable producers is taken as a yardstick. The net present value (NPV) of the Blackwater project is C$ 2.151 billion according to the feasibility study (gold price: US$ 1,600 per ounce). This is more than double the current market capitalization. With a current gold price of more than US$1,900, the current NPV should even be significantly higher. The current market capitalization of C$ 1 billion is also well below the cost of acquiring and building the mine.

Follow us on Twitter (X)!

However, there are two major risks: Not everything always goes as planned during the construction of a mine. Technical problems during construction can delay the start of production, which can postpone the expected cash flows into the future. In addition, the geology of British Columbia is considered to be somewhat difficult. On a positive note, a company as reputable as Wheaton Precious Metals has invested nearly half a billion dollars in this project.

Conclusion: The share price performance so far looks promising: After the purchase of the Blackwater project, the stock rose from C$ 1 to C$ 7 in a few months. In the course of the approval and financing process, roughly half of this price gain was lost again. Since the start of construction of the mine, Artemis Gold has been in a slight upward trend. The share price should be able to rise further until the start of production in 2024 if mine construction proceeds as planned. In addition to the buffer to the gold price, the low costs during operation and the long life of the mine are convincing. In view of the few gold mines that are currently under construction at all (we had already presented Marathon Gold to you), Artemis Gold is also a takeover candidate in our opinion.

Please note: Investments in the capital markets are associated with a high level of risk. Investors can lose all of their capital – and more. Remember to do your own due diligence! The content of this website is intended exclusively for readers who are permanent residents of Germany. The German disclaimer applies (see below). The author owns shares in i-80 Gold.

You might also be interested in…

- Exasol: Still waiting for the turnaround!

- Redcare Pharmacy shows strong growth!

- Covestro: Adnoc increases takeover bid!

- Royal Helium: Noble Gases for the Space Industry!

- Marathon Gold: The next gold mine in Newfoundland!

- Ranking: The most innovative Companies in the World

- Tourmaline Oil: Betting on a higher natural gas price

- Banyan Gold: New Gold rush in the Yukon!

- DHT Holdings: Tankers as cash machine!

- Ranking: The largest Copper-Mines in the World!

- Xortx Therapeutics: Now it’s time for the final spurt!

- Delignit: Back on track!

- Beaconsmind: Digital solutions for store-based business

- Nippon Sanso: Moat und catch-up potential

- Ero Copper: A copper producer that hardly anyone knows

- Obsidian Energy: The big One among the smaller Oil-Producers

- Ranking: Best selling Gaming consoles in the World!

- Net Digital: A German payment service provider with AI!

Graphics: Das Investor Magazin, Pixabay, Artemis Gold (Screenshot website & presentation)

_____________________________________________________________________________________

DISCLAIMER. BITTE UNBEDINGT BEACHTEN!

Grundsätzlicher Hinweis auf mögliche Interessenskonflikte gemäß Paragraph 34 WpHG i.V.m. FinAnV: Mitarbeiter, Berater und freie Redakteure von www.investor-magazin.de können jederzeit Aktien an allen vorgestellten Unternehmen halten, kaufen oder verkaufen. Das gilt ebenso für abgeleitete Finanzinstrumente. Sollte dies der Fall sein, wird dies an dieser Stelle genannt.

Zudem weisen wir gerne auf die Broschüren der BaFin zum Schutz vor unseriösen Angeboten hin:

– Geldanlage – Wie Sie unseriöse Anbieter erkennen (pdf/113 KB)

– Wertpapiergeschäfte – Was Sie als Anleger beachten sollten (pdf/326 KB)

Risikohinweis: Wir weisen darauf hin, dass der Erwerb von Wertpapieren jeglicher Art hohe Risiken birgt, die zum Totalverlust des eingesetzten Kapitals führen können – oder darüber hinaus. Jegliche auf dieser Webseite verbreiteten Artikel rufen explizit nicht zum Kauf oder Verkauf von Wertpapieren auf. Es kommt weder eine Anlageberatung noch ein Anlagevermittlungsvertrag mit dem Leser zustande. Die hier dargestellten Informationen beziehen sich auf das Unternehmen und nicht auf die persönliche Situation des Lesers. Grundsätzlich möchten wir Ihnen Ideen für unseres Erachtens aussichtsreiche Investments geben. Bitte passen Sie diese dann an Ihre individuelle Strategie und persönliche Finanzsituation an. Und bitte vergessen Sie nicht: Wir haben keine Glaskugel, wir haben aber viel Erfahrung und Wissen. Daher raten wir stets dazu, dass Sie als Leser ihre eigenen Analysen vornehmen. Do your own Due Dilligence!

Datenschutz: Wir geben Ihre Daten nicht an externe Dritte weiter. Aufgrund der neuen Datenschutz Grundverordnung haben wir unsere Datenschutzerklärung aktualisiert. Sie können sich für unseren kostenlosen Newsletter hier anmelden. Eine Abmeldung ist jederzeit per Mail an info (at) investor-magazin.de möglich.

Keine Haftung für Links: Mit Urteil vom 12.Mai 1998 hat das Landgericht Hamburg entschieden, dass man durch die Ausbringung eines Links die Inhalte der verlinkten Seiten ggf. mit zu verantworten hat. Dies kann nur dadurch verhindert werden, dass man sich ausdrücklich von diesem Inhalt distanziert. Für alle Links auf dieser Webseite gilt: Der Betreiber distanziert sich hiermit ausdrücklich von allen Inhalten aller verlinkten Seiten und macht sich diese Inhalte nicht zu Eigen.

Keine Finanzanalyse: Der Herausgeber weist ausdrücklich darauf hin, dass es sich bei den Besprechungen um keine Finanzanalysen nach deutschem Kapitalmarktrecht handelt, sondern um journalistische und/oder werbliche Texte. Sie erfüllen deshalb nicht die Anforderungen zur Gewährleistung der Objektivität von Anlageempfehlungen. Bitte beachten Sie außerdem: Die Nutzung dieses Informationsangebots ist ausschließlich natürlichen Personen vorbehalten, die ihren dauerhaften Wohnsitz in der Bundesrepublik Deutschland haben. Allen anderen natürlichen oder juristischen Personen oder Personengruppen ist die Nutzung wie auch der Zugang zu dieser Webseite nicht gestattet.

Urheberrecht: Der Inhalt und die Struktur dieser Webseite sind urheberrechtlich geschützt und Eigentum des Betreibers. Sie dürfen nicht ohne vorherige schriftliche Zustimmung weder verwendet noch reproduziert werden, auch nicht auszugsweise. Der Betreiber ist bestrebt, in allen seinen Publikationen die Urheberrechte der verwendeten Grafiken, Bilder und Texte zu beachten. Allein aufgrund der bloßen Nennung oder Nichtnennung von Rechten Dritter ist nicht der Schluss zu ziehen, dass diese nicht geschützt sind! Sollte der Betreiber dennoch gegen Rechte Dritter verstoßen haben, wird er unter dem Vorbehalt der Prüfung unverzüglich jegliche Dateien entfernen, sofern er auf die Rechtsverletzung schriftlich hingewiesen wurde.

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr