“12,500% price gain!” Perpetua Resources and its Stibnite project were abused by a US stock market letter with lurid advertising. Although this is groundless, the company’s Stibnite project has great strategic value for the USA. We do a reality check: what is really behind the asset and the share?

12.500? “Exaggerated by far!”

Perpetua Resources (US$ 3.8150 | $PPTA) is working very solidly to revive an abandoned antimony and gold mine in the US state of Idaho. The 12,500% are by far exaggerated, wrote Chris Fogg, who is responsible for investor relations at Perpetua Resources. However, the share, which is listed on the Nasdaq and the TSX in Toronto, is certainly an interesting investment. If everything goes according to plan, one of the largest gold mines in the USA will be built here by 2028.

Successful new start

Midas Gold, as Perpetua was known until 2021, had been working on the Stibnite project since 2011. The restart began in 2020 when a famous hedge fund exchanged two convertible bonds for shares. Hedge fund manager John Paulson became famous for betting on falling share prices in 2008 and making a lot of money. His company Paulson & Co. is currently the major shareholder in Perpetua Resources with 39.2%. In this respect, the stock market letter advertisement is right about one thing: John Paulson should know what a profitable investment is.

In December 2020, a new top manager, Laurel Sayer, was appointed as CEO. In February 2021, the name was changed from Midas Gold to Perpetua Resources. The name is a direct reference to Idaho’s motto, Este Perpetua. “Perpetua” translates into English as “eternal”. The name is intended to express that the company wants to use Idaho’s abundant resources for generations to come. A great deal has been achieved since 2021, particularly in terms of the approval of mining operations. All permits should be in place by the end of 2024 – the trigger for a higher share price for speculators.

A huge environmental mess

If you look at the mine site from the air, you realize that it’s all a huge mess. The mountain slopes have been eaten away by erosion. Over the past 120 years, hundreds of thousands of tons of toxic waste material have been dumped unchecked, and the water and soil are contaminated. In 1938, a river was diverted so that the salmon can no longer migrate upstream. Former operators of the mine never thought to clean up the environmental damage they had caused.

No wonder there are environmentalists who are in fundamental opposition to reviving the mine. The new management seems to be far more sensitive than the old one. It takes these concerns seriously and is looking for solutions. For example, a lawsuit filed by the Naz Perce against Midas Gold by Perpetua Resources was ended with a settlement (the indigenous people there have had fishing rights since the middle of the 19th century). A company founded by the indigenous population was hired for clean-up work. Local companies from all sectors are generally given preference when awarding contracts. Future mine workers are expected to earn far more than the current average wage in central Idaho of 30,000 US dollars per year.

One of the most profitable gold mines in the world

If the 2020 Definitive Deasibility Study (DFS) is implemented as planned, it will not only create one of the largest gold mines in the USA, but also one of the most profitable in the world. The average mining costs of gold have risen enormously over the past 20 years. From US$ 300 per ounce in 2000 to US$ 900 per ounce in 2012 to US$ 1,358 per ounce in the first quarter of 2023. Stibnite would be extremely profitable in comparison, with cash costs of US$ 571 per ounce or US$ 636 per ounce on an AISC basis (including antimony and silver as by-products). Mining is so cost-effective because the rock can be extracted by open-pit mining, with a comparatively high ore grade of 1.43 grams of gold per tonne of rock. These gold grades are usually only found underground.

The processing capacity of the planned plant is expected to be an enormous 22,050 tons per day. This is two thirds of the capacity of Canadian Malartic, the largest gold mine in Canada (owned by Agnico Eagle). It is expected to produce 297,000 ounces of gold per year. That is also world class. A relatively modest US$ 1.3 billion are to be invested (including cost overrun reserve). However, inflation since 2020 has not yet been taken into account and is likely to result in higher capex when the feasibility study is updated. For a company with a market capitalization of US$ 300 million, such amounts are not easy to raise, but not impossible either. After all, John Paulson is backed by a solvent major shareholder.

We asked Chris Fogg to what extent there are already considerations regarding the financing of the project, which is due at the end of 2024 / beginning of 2025. His answer was very specific: “We have had encouraging discussions regarding the debt portion of our financing with the US Export Import Bank, which has launched some new programs. These programs include the Make More in America Initiative and the China Transformational Program. The rest of the financing will be done through a traditional capital increase, royalties and the like. In terms of equity, we expect our stock to be re-priced as we progress through the permitting process and get closer to a decision to build the mine. That would make it easier to raise equity.”

Strategically important for the USA

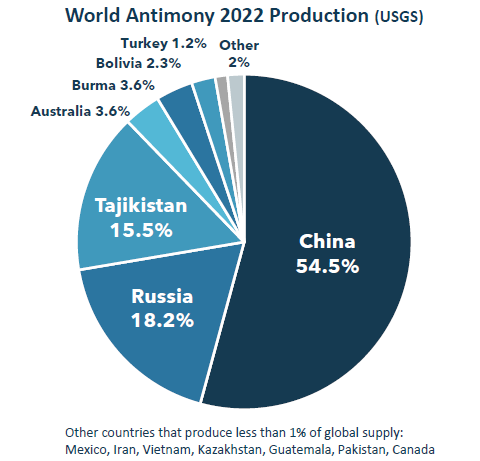

What Chris Fogg is suggesting here is crucial for the company and something special for a gold mine. The reopening of the Stibnite mine is strategically important for the USA. The mine already supplied the antimony for the production of munitions in the fight against the Nazi regime in World War 2. Currently, 88.2% of the world’s antimony comes from China (54.5%), Russia (18.2%) and Tajikistan (15.5%). This explains the US government’s interest in this mine. Perpetua Resources is in the comfortable position of currently having its operating costs covered by the US Department of Defense, from which the company has received funds of US$ 59.4 million under the Defense Production Act. This is also remarkable for a gold company; the by-product antimony makes it possible.

The critical metal antimony is not only important for arms production. It is needed for the manufacture of high-tech products such as smartphones. Perpetua also concluded a supply contract with Ambri, a manufacturer of antimony-based energy storage systems. With the energy transition and the restructuring of electricity infrastructure worldwide, these storage systems should become even more important.

Perpetua Resources: a good investment?

We assume that the mine will be built. It is simply too important for the strategic interests of the USA in light of the conflicts with Russia, China and some other countries. But how do you value a mining company that will not start production for another four to five years?

In the long term, this task is relatively simple. When Stibnite is in production, Perpetua Resources will be in the same league as Lundin Gold, which currently has a market capitalization of US$ 3 billion. This does not yet take into account a higher gold price or the capital dilution caused by the equity portion of the mine financing.

Perpetua Resources itself sees a short-term re-rating potential once all permits for the construction of the mine have been obtained. The share is currently valued at 10% of the net asset value. Companies whose mines have already been approved or are already under construction have significantly higher values. Examples include Skeena Resources (26%), NovaGold (28%), Artemis Gold (58%) and Ascot Resources (63%). However, none of these companies have any antimony in their assets.

Conclusion: Excluding the two mining giants Barrick Gold and Newmont, Perpetua Resources has the largest secured gold reserves in the US with 4.8 million ounces. These are currently valued at 38 US$ per ounce. Compared to Ascot (US$ 217), Artemis (US$ 157), Skeena (US$ 139) and NovaGold (US$ 50), there is also re-rating potential according to this criterion. However, the all-important operating permit has not yet been granted. Allowing the Perpetua Resources share a 12,500% upside potential is exaggerated. Perpetua Resources offers above-average price potential over the next year, but also in the long term, and that with comparatively little risk.

Please note: Investments in the capital markets are associated with a high level of risk. Investors can lose all of their capital – and more. Remember to do your own due diligence! The content of this website is intended exclusively for readers who are permanent residents of Germany. The German disclaimer applies (see below).

You might also be interested in…

- CR Energy: Germanys hidden champion in energy self-sufficient construction

- Aura Minerals: Undervaluation and strong growth!

- Redcare Pharmacy: E-Prescription provides more than just imagination

- Friwo promises a turnaround in 2024

- Bitcoin: Is the perfect storm brewing here?

- Uranium Energy: Profit from the rising Uranium Price?

- Is Couer Mining a buy after 80% drop in share price?

- TUI: End of the Short attacks?

- Pan American Silver: Already on special offer?

- PNE Wind: A second chance for investors?

- Nvidia: Demolished expectations!

- Apple: Buy the dip?

- Artemis Gold: This share travels under the Radar!

- Exasol: Still waiting for the turnaround!

- Redcare Pharmacy shows strong growth!

- Covestro: Adnoc increases takeover bid!

- Royal Helium: Noble Gases for the Space Industry!

- Marathon Gold: The next gold mine in Newfoundland!

- Ranking: The most innovative Companies in the World

- Tourmaline Oil: Betting on a higher natural gas price

- Banyan Gold: New Gold rush in the Yukon!

- DHT Holdings: Tankers as cash machine!

- Ranking: The largest Copper-Mines in the World!

- Xortx Therapeutics: Now it’s time for the final spurt!

- Delignit: Back on track!

- Beaconsmind: Digital solutions for store-based business

- Nippon Sanso: Moat und catch-up potential

- Ero Copper: A copper producer that hardly anyone knows

- Obsidian Energy: The big One among the smaller Oil-Producers

- Ranking: Best selling Gaming consoles in the World!

- Net Digital: A German payment service provider with AI!

Graphics: Das Investor Magazin, Pixabay

_____________________________________________________________________________________

DISCLAIMER. BITTE UNBEDINGT BEACHTEN!

Grundsätzlicher Hinweis auf mögliche Interessenskonflikte gemäß Paragraph 34 WpHG i.V.m. FinAnV: Mitarbeiter, Berater und freie Redakteure von www.investor-magazin.de können jederzeit Aktien an allen vorgestellten Unternehmen halten, kaufen oder verkaufen. Das gilt ebenso für abgeleitete Finanzinstrumente. Sollte dies der Fall sein, wird dies an dieser Stelle genannt.

Zudem weisen wir gerne auf die Broschüren der BaFin zum Schutz vor unseriösen Angeboten hin:

– Geldanlage – Wie Sie unseriöse Anbieter erkennen (pdf/113 KB)

– Wertpapiergeschäfte – Was Sie als Anleger beachten sollten (pdf/326 KB)

Risikohinweis: Wir weisen darauf hin, dass der Erwerb von Wertpapieren jeglicher Art hohe Risiken birgt, die zum Totalverlust des eingesetzten Kapitals führen können – oder darüber hinaus. Jegliche auf dieser Webseite verbreiteten Artikel rufen explizit nicht zum Kauf oder Verkauf von Wertpapieren auf. Es kommt weder eine Anlageberatung noch ein Anlagevermittlungsvertrag mit dem Leser zustande. Die hier dargestellten Informationen beziehen sich auf das Unternehmen und nicht auf die persönliche Situation des Lesers. Grundsätzlich möchten wir Ihnen Ideen für unseres Erachtens aussichtsreiche Investments geben. Bitte passen Sie diese dann an Ihre individuelle Strategie und persönliche Finanzsituation an. Und bitte vergessen Sie nicht: Wir haben keine Glaskugel, wir haben aber viel Erfahrung und Wissen. Daher raten wir stets dazu, dass Sie als Leser ihre eigenen Analysen vornehmen. Do your own Due Dilligence!

Datenschutz: Wir geben Ihre Daten nicht an externe Dritte weiter. Aufgrund der neuen Datenschutz Grundverordnung haben wir unsere Datenschutzerklärung aktualisiert. Sie können sich für unseren kostenlosen Newsletter hier anmelden. Eine Abmeldung ist jederzeit per Mail an info (at) investor-magazin.de möglich.

Keine Haftung für Links: Mit Urteil vom 12.Mai 1998 hat das Landgericht Hamburg entschieden, dass man durch die Ausbringung eines Links die Inhalte der verlinkten Seiten ggf. mit zu verantworten hat. Dies kann nur dadurch verhindert werden, dass man sich ausdrücklich von diesem Inhalt distanziert. Für alle Links auf dieser Webseite gilt: Der Betreiber distanziert sich hiermit ausdrücklich von allen Inhalten aller verlinkten Seiten und macht sich diese Inhalte nicht zu Eigen.

Keine Finanzanalyse: Der Herausgeber weist ausdrücklich darauf hin, dass es sich bei den Besprechungen um keine Finanzanalysen nach deutschem Kapitalmarktrecht handelt, sondern um journalistische und/oder werbliche Texte. Sie erfüllen deshalb nicht die Anforderungen zur Gewährleistung der Objektivität von Anlageempfehlungen. Bitte beachten Sie außerdem: Die Nutzung dieses Informationsangebots ist ausschließlich natürlichen Personen vorbehalten, die ihren dauerhaften Wohnsitz in der Bundesrepublik Deutschland haben. Allen anderen natürlichen oder juristischen Personen oder Personengruppen ist die Nutzung wie auch der Zugang zu dieser Webseite nicht gestattet.

Urheberrecht: Der Inhalt und die Struktur dieser Webseite sind urheberrechtlich geschützt und Eigentum des Betreibers. Sie dürfen nicht ohne vorherige schriftliche Zustimmung weder verwendet noch reproduziert werden, auch nicht auszugsweise. Der Betreiber ist bestrebt, in allen seinen Publikationen die Urheberrechte der verwendeten Grafiken, Bilder und Texte zu beachten. Allein aufgrund der bloßen Nennung oder Nichtnennung von Rechten Dritter ist nicht der Schluss zu ziehen, dass diese nicht geschützt sind! Sollte der Betreiber dennoch gegen Rechte Dritter verstoßen haben, wird er unter dem Vorbehalt der Prüfung unverzüglich jegliche Dateien entfernen, sofern er auf die Rechtsverletzung schriftlich hingewiesen wurde.

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr