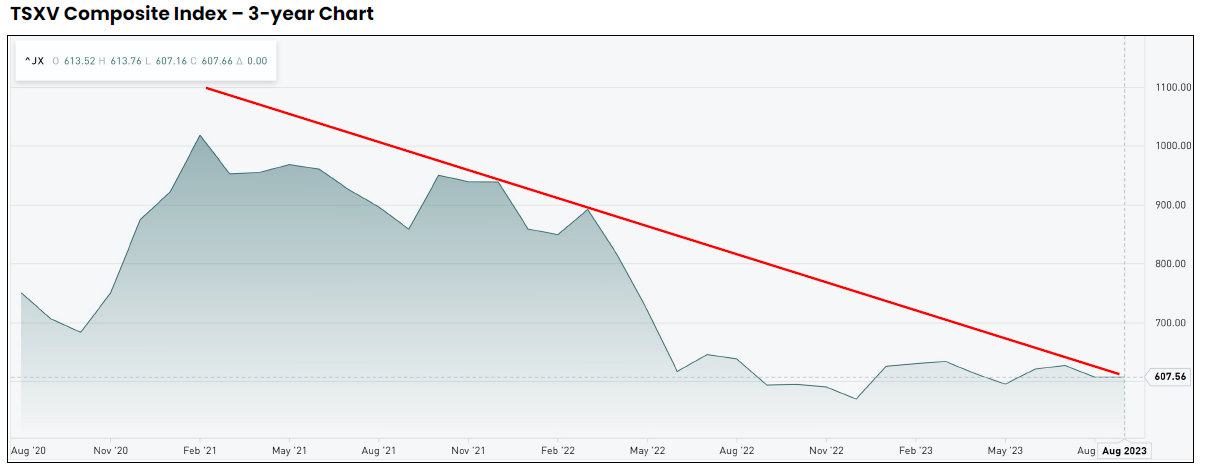

Orecap Invest is a small but excellent Canadian company that focus on “special situations” in the commodities sector. The share price has risen by around 50% so far in 2024. The company is benefiting from difficult financing markets and the low valuations of smaller commodity companies.

Orecap Invest: money and know-how!

The business model of Orecap Invest (C$ 0.05 | TSXV: OCI), which was still called Orefinders until May 2023, is complicated at first glance, but actually quite simple. On the one hand, Orecap buys attractive properties when they are offered at a bargain price in weak capital market phases. The projects are defined more precisely through exploration and then optioned out to a financially strong partner or floated on the stock market as an independent company. Secondly, Orecap helps with money, know-how and contacts when a mining company is in difficulties and receives shares in return.

The Ore Group

One visible result of these activities is the Ore Group, a group of exploration companies that are linked to Orecap in terms of personnel and/or capital. They also appear together on YouTube. The current members are: QC Copper & Gold (copper in Canada), Baselode Energy (uranium in Canada), Mistango River (gold in Canada), American Eagle (copper and gold in Canada), Metal Energy (lithium and nickel in Canada), Awalé Resources (copper and gold in Côte d’Ivoire) and privately held Cuprum Corp (copper in Canada). German investors will soon be able to take a closer look at QC Copper & Gold. The company will be presenting at the conference Deutsche Goldmesse on May 3rd & 4th in Frankfurt.

The investments at a glance

Orecap currently holds stakes in four of the listed Ore Group companies: Mistango River (13.9%), QC Copper & Gold (2.9%), American Eagle Gold (9.9%) and Awalé Resources (13.3%). As at March 20, the market value of these investments amounted to C$ 12.067 million. In addition, there is the 42.7% stake in Cuprum (purchase price: C$ 1.5 million) and four exploration projects in Canada.

Since the company was founded, Orecap has invested a total of C$ 7.28 million in seven companies. The realized or as yet unrealized capital gain is an impressive 254%. This is remarkable in this market environment, which is difficult for small commodity companies. There were three spin-outs. Shares from the investment portfolio were distributed to Orefinders shareholders. These were the shares of Baselode Energy (price gain as at 8.1.2024: 703%), American Eagle (457%) and QC Copper & Gold (287%).

A hungry team with well-known partners

Orecap Invest itself has a market capitalization of just CAD 11.2 million. And yet it has achieved a great deal since the company was founded in 2011. This is only possible with the right people. Chairman and CEO Stephen Stewart is still a relatively young entrepreneur who practically grew up in a mining household. His father Alex Stewart worked for more than fifty years as a commercial lawyer specializing in mining companies. He helps the company as a board member. Stephen Stewart prescribed himself a relatively modest salary as boss. But he also said in an interview: “My goal is to increase my money tenfold, twentyfold or fiftyfold.” As one of the younger mining managers, he still has enough time for this and obviously enough drive and hunger. Unfortunately, many managers in the ranks of junior companies are already very old.

Director Charles Beaudry is a geologist in active retirement who previously worked for Xstrata, which later merged into Glencore. Gerry Brockelsby, a renowned investment banker with 45 years of experience, recently joined the team. It is therefore no wonder that Agnico-Eagle (9.9%) and Eric Sprott (9%) are anchor shareholders in Orecap Invest. There are also interesting partners: mining giant Newmont joined Awalé Resources as part of the rescue operation. Teck Resources is American Eagle’s largest shareholder with a 19.9% stake.

Failures were not absent

Every success story has its failures. This is also the case with Orecap Invest. When the company was still called Orefinders, three properties near the Macassa mine were optioned to its direct neighbor Kirkland Lake Gold. From their perspective, the deal made sense: Macassa is one of the most profitable gold mines in the Abitibi region of Canada, and was hugely important to Kirkland Lake Gold. Agnico-Eagle took over Kirkland Lake Gold and had completely different priorities. The deal was terminated by mutual agreement in early 2024. The three projects reverted 100% to Orecap – and are now waiting to be exploited by another partner. After all, Orecap Invest “secretly” bought the third-largest exploration area on Ontario’s side of the Cadillac Trench between 2015 and 2020. There should be enough other interested parties.

After the spin-out, American Eagle explored a promising project in the US state of Nevada, very close to Nevada Gold Mines (a joint venture between Barrick Gold and Newmont). However, the results fell far short of expectations and the share price collapsed. American Eagle acquired the NAK copper-gold project in Canada via Orecap – and its first drilling results then brought great success. There was one day when the share price jumped by over 500%. After selling its coal activities to Glencore, Teck Resources seems to have made the right move towards copper by acquiring a 19.9% stake in American Eagle.

Active in Africa and Ontario

The rescue of the over-indebted exploration company Awalé Resources and the purchase of a 42.7% stake in Cuprum were the last two major deals. Awalé got a new CEO in veteran Andrew Chubb, an economic geologist with experience in Africa. Orecap Invest repaired the badly battered balance sheet in cooperation with Newmont Ventures. Stephen Stewart and Charles Beaudry, Orecap’s senior geologist, joined the Supervisory Board. This was good for the company’s share price.

With the 42.7% stake in Cuprum in Ontario, a significant share in Thierry, the second-largest copper project in the eastern part of Canada, was acquired in September 2023. Copper was mined here from 1976 to 1982, after which production was discontinued due to the low metal price. There is a preliminary economic assessment (PEA) from 2021 for an underground operation. An IPO of the company is also planned for 2024.

Conclusion: In relation to the market value of the individual components, Orecap Invest is undervalued. If you like, you get certain projects and the management for free. But who is the share suitable for? First of all, for anyone who wants to invest in junior mining stocks but does not have the know-how or time to select their own shares. What Orecap Invest is doing is certainly walking a tightrope, albeit successfully so far. Nevertheless, their strategic approach is certainly more promising than gambling with small explorers. The ideal investor is probably the high-net-worth investor who wants to diversify an opportunity-oriented portfolio and is happy to leave this work to the professionals.

Please note: Investments in the capital markets are associated with a high level of risk. Investors can lose all of their capital – and more. Remember to do your own due diligence! The content of this website is intended exclusively for readers who are permanent residents of Germany. The German disclaimer applies (see below).

You might also be interested in…

- Perpetua Resources: A Gold mine with strategic value for the USA

- CR Energy: Germanys hidden champion in energy self-sufficient construction

- Aura Minerals: Undervaluation and strong growth!

- Redcare Pharmacy: E-Prescription provides more than just imagination

- Friwo promises a turnaround in 2024

- Bitcoin: Is the perfect storm brewing here?

- Uranium Energy: Profit from the rising Uranium Price?

- Is Couer Mining a buy after 80% drop in share price?

- TUI: End of the Short attacks?

- Pan American Silver: Already on special offer?

- PNE Wind: A second chance for investors?

- Nvidia: Demolished expectations!

- Apple: Buy the dip?

- Artemis Gold: This share travels under the Radar!

- Exasol: Still waiting for the turnaround!

- Redcare Pharmacy shows strong growth!

- Covestro: Adnoc increases takeover bid!

- Royal Helium: Noble Gases for the Space Industry!

- Marathon Gold: The next gold mine in Newfoundland!

- Ranking: The most innovative Companies in the World

- Tourmaline Oil: Betting on a higher natural gas price

- Banyan Gold: New Gold rush in the Yukon!

- DHT Holdings: Tankers as cash machine!

- Ranking: The largest Copper-Mines in the World!

- Xortx Therapeutics: Now it’s time for the final spurt!

- Delignit: Back on track!

- Beaconsmind: Digital solutions for store-based business

- Nippon Sanso: Moat und catch-up potential

- Ero Copper: A copper producer that hardly anyone knows

- Obsidian Energy: The big One among the smaller Oil-Producers

- Ranking: Best selling Gaming consoles in the World!

- Net Digital: A German payment service provider with AI!

Graphics: Das Investor Magazin, Pixabay

_____________________________________________________________________________________

DISCLAIMER. BITTE UNBEDINGT BEACHTEN!

Grundsätzlicher Hinweis auf mögliche Interessenskonflikte gemäß Paragraph 34 WpHG i.V.m. FinAnV: Mitarbeiter, Berater und freie Redakteure von www.investor-magazin.de können jederzeit Aktien an allen vorgestellten Unternehmen halten, kaufen oder verkaufen. Das gilt ebenso für abgeleitete Finanzinstrumente. Sollte dies der Fall sein, wird dies an dieser Stelle genannt. Der Autor hält folgende Aktien: Orecap Invest.

Zudem weisen wir gerne auf die Broschüren der BaFin zum Schutz vor unseriösen Angeboten hin:

– Geldanlage – Wie Sie unseriöse Anbieter erkennen (pdf/113 KB)

– Wertpapiergeschäfte – Was Sie als Anleger beachten sollten (pdf/326 KB)

Risikohinweis: Wir weisen darauf hin, dass der Erwerb von Wertpapieren jeglicher Art hohe Risiken birgt, die zum Totalverlust des eingesetzten Kapitals führen können – oder darüber hinaus. Jegliche auf dieser Webseite verbreiteten Artikel rufen explizit nicht zum Kauf oder Verkauf von Wertpapieren auf. Es kommt weder eine Anlageberatung noch ein Anlagevermittlungsvertrag mit dem Leser zustande. Die hier dargestellten Informationen beziehen sich auf das Unternehmen und nicht auf die persönliche Situation des Lesers. Grundsätzlich möchten wir Ihnen Ideen für unseres Erachtens aussichtsreiche Investments geben. Bitte passen Sie diese dann an Ihre individuelle Strategie und persönliche Finanzsituation an. Und bitte vergessen Sie nicht: Wir haben keine Glaskugel, wir haben aber viel Erfahrung und Wissen. Daher raten wir stets dazu, dass Sie als Leser ihre eigenen Analysen vornehmen. Do your own Due Dilligence!

Datenschutz: Wir geben Ihre Daten nicht an externe Dritte weiter. Aufgrund der neuen Datenschutz Grundverordnung haben wir unsere Datenschutzerklärung aktualisiert. Sie können sich für unseren kostenlosen Newsletter hier anmelden. Eine Abmeldung ist jederzeit per Mail an info (at) investor-magazin.de möglich.

Keine Haftung für Links: Mit Urteil vom 12.Mai 1998 hat das Landgericht Hamburg entschieden, dass man durch die Ausbringung eines Links die Inhalte der verlinkten Seiten ggf. mit zu verantworten hat. Dies kann nur dadurch verhindert werden, dass man sich ausdrücklich von diesem Inhalt distanziert. Für alle Links auf dieser Webseite gilt: Der Betreiber distanziert sich hiermit ausdrücklich von allen Inhalten aller verlinkten Seiten und macht sich diese Inhalte nicht zu Eigen.

Keine Finanzanalyse: Der Herausgeber weist ausdrücklich darauf hin, dass es sich bei den Besprechungen um keine Finanzanalysen nach deutschem Kapitalmarktrecht handelt, sondern um journalistische und/oder werbliche Texte. Sie erfüllen deshalb nicht die Anforderungen zur Gewährleistung der Objektivität von Anlageempfehlungen. Bitte beachten Sie außerdem: Die Nutzung dieses Informationsangebots ist ausschließlich natürlichen Personen vorbehalten, die ihren dauerhaften Wohnsitz in der Bundesrepublik Deutschland haben. Allen anderen natürlichen oder juristischen Personen oder Personengruppen ist die Nutzung wie auch der Zugang zu dieser Webseite nicht gestattet.

Urheberrecht: Der Inhalt und die Struktur dieser Webseite sind urheberrechtlich geschützt und Eigentum des Betreibers. Sie dürfen nicht ohne vorherige schriftliche Zustimmung weder verwendet noch reproduziert werden, auch nicht auszugsweise. Der Betreiber ist bestrebt, in allen seinen Publikationen die Urheberrechte der verwendeten Grafiken, Bilder und Texte zu beachten. Allein aufgrund der bloßen Nennung oder Nichtnennung von Rechten Dritter ist nicht der Schluss zu ziehen, dass diese nicht geschützt sind! Sollte der Betreiber dennoch gegen Rechte Dritter verstoßen haben, wird er unter dem Vorbehalt der Prüfung unverzüglich jegliche Dateien entfernen, sofern er auf die Rechtsverletzung schriftlich hingewiesen wurde.

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr