The share price of Uranium Energy, the No. 2 uranium company in North America after Cameco, has risen tenfold since its low in 2020, from 50 cents to over $5. Investors are currently taking profits at this level. CEO Amir Adnani is brimming with self-confidence and told investors in Frankfurt that the share price could still rise to “over twenty dollars”.

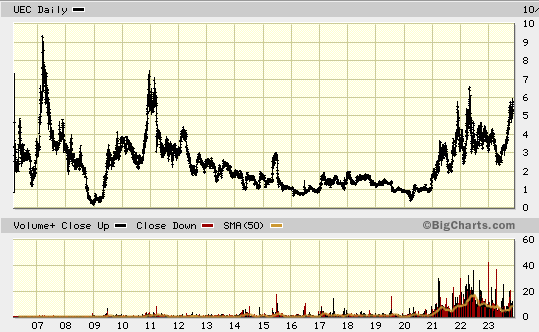

An extremely cyclical share

No question: Uranium Energy ($5.64 | $UEX) is an extremely cyclical share that could make – or lose – a lot of money. The share price is extremely volatile and essentially follows the price of uranium. The sector has been in crisis mode since 2011, because the price of uranium oxide was usually far below the high production costs of western industrialized countries. It was often cheaper to mothball mines and processing plants than to produce the radioactive material. The supply of uranium came from republics of the former Soviet Union. The damage to the industry’s image caused by the Fukushima disaster was huge anyway.

Uranium Energy’s share price performance is not for investors with weak nerves. After crashing from its interim high at the end of 2010, the share price fluctuated around the one US dollar mark for seven years. From 2021, stock market turnover suddenly exploded. Hard-nosed speculators had obviously come to the realization that uranium could only go up again. They drove Uranium Energy’s share price upwards amid wild fluctuations. The company’s market capitalization now stands at an impressive $2 billion.

Brought back to life

“The uranium price only came back to life 45 days ago, after eleven years of decline,” said Amir Adnani during the interview in Frankfurt. An interesting statement. He was referring to the fact that it has only been worthwhile mining and processing uranium in North America again for about six weeks. He continued: “73 dollars per pound is a good price to get into production.” His company’s break-even point is $40, he explained when asked. However, the uranium price would have to be constantly much higher to really make money.

With his aggressive bets, Amir Adnani is not a manager that everyone has to like. However, he has done a good job at Uranium Energy in recent years. Where others were timid, he took bold action. He bought uranium mines and processing plants in the US states of Texas and Wyoming at ridiculously low prices, which had been shut down by their previous owners due to the low price. He also acquired development projects with existing operating licenses. He also acquired Rough Rider, one of the best uranium properties in the world, and other exploration projects from Rio Tinto in Canada.

These acquisitions cost several hundred million dollars. Nevertheless, Uranium Energy is debt-free. We asked how that works. Amir Adnani: “We used our shares to finance this.” When cash was required for takeovers, capital increases were carried out. Or the seller was paid directly with shares. Of course, this led to capital dilution, which is always bad for existing shareholders. The management of Uranium Energy was well aware of this fact, and also that its own share price was at rock bottom. Nevertheless, added value was created from the company’s perspective because assets were acquired that were even more undervalued than the company’s own shares, according to Adnani.

Start of production in mid-2024

Amir Adnani assumes that production can begin in mid-2024 at the currently decommissioned but fully operational plants in Texas and Wyoming. However, he is still waiting for the uranium price, which has shot up far too quickly in recent weeks, to stabilize at an attractive level. About the technology: The uranium is extracted using in-situ recovery (ISR). In this process, liquid is injected into uranium-bearing sandstone and the metal dissolved in the liquid is pumped out. This solution is then purified in the processing plant in several steps until marketable uranium oxide remains at the end.

Profits and cash flows still a dream of the future!

Uranium Energy has 8 million pounds per year of approved capacity. In 2024, 1 million pounds are to be produced and output is to be increased to five to six million pounds per year over the next four to five years. Large profits and free cash flows are therefore still dreams of the future.

Uranium Energy sees itself as the “fastest growing uranium company”. The aim is therefore more likely to be to increase the net asset value (NAV). Despite the sharp rise in the share price, the ratio of share price to NAV is only 0.7. By comparison, Cameco has a ratio of 1.5. Amir Adnani: “Whether you buy our shares depends on your opinion of the uranium price. I have a personal price target of over 20 dollars. This should be reached if the uranium price rises to over 100 dollars.”

A growing supply deficit

At least the developments on the market suggest that Adnani could be right:

- Demand for uranium oxide is estimated at 195 million pounds this year, while supply is estimated at 143 million pounds, which corresponds to a supply deficit of 52 million pounds. This is expected to rise cumulatively to 113 million pounds by 2025 and to around 476 million pounds by 2033 – the strongest argument for higher prices.

- Almost half of current uranium production is located in three former Soviet republics: Kazakhstan (54.6 million pounds), Uzbekistan (8.8 million pounds) and Russia (7.7 million pounds). Production in North America is to be increased for political reasons. The USA is the world’s largest operator of nuclear power plants and the largest consumer of uranium at 44.4 million pounds per year. However, it does not rank among the top 10 uranium producers worldwide.

- There are currently 436 nuclear reactors in operation worldwide, 60 are under construction and 69 have been completed since 2013. The annual growth in uranium demand (2021-2041) is estimated at 3.1%.

- The highest uranium price was $138 per pound in 2005 (after problems at two of the world’s largest mines). The lowest price was recorded in November 2016 at $17.75 per pound, which was a 12-year low. Amir Adnani: “The 138 dollars from back then is equivalent to 200 dollars today due to inflation.” Fundamentally, therefore, there is a lot to be said for a multi-year bull market.

One of the few sectors to perform well

Conclusion: Alongside oil and gas, uranium has recently been one of the few sectors in the commodities sector that has performed well on the stock markets. This positive trend should be able to continue for a few more years, although strong price fluctuations are to be expected. When uranium is booming, Uranium Energy, one of the most popular stocks, is certainly not a bad choice. However, we are currently seeing profit-taking on the market.

Please note: Investments in the capital markets are associated with a high level of risk. Investors can lose all of their capital – and more. Remember to do your own due diligence! The content of this website is intended exclusively for readers who are permanent residents of Germany. The German disclaimer applies (see below).

You might also be interested in…

- Is Couer Mining a buy after 80% drop in share price?

- TUI: End of the Short attacks?

- Pan American Silver: Already on special offer?

- PNE Wind: A second chance for investors?

- Nvidia: Demolished expectations!

- Apple: Buy the dip?

- Artemis Gold: This share travels under the Radar!

- Exasol: Still waiting for the turnaround!

- Redcare Pharmacy shows strong growth!

- Covestro: Adnoc increases takeover bid!

- Royal Helium: Noble Gases for the Space Industry!

- Marathon Gold: The next gold mine in Newfoundland!

- Ranking: The most innovative Companies in the World

- Tourmaline Oil: Betting on a higher natural gas price

- Banyan Gold: New Gold rush in the Yukon!

- DHT Holdings: Tankers as cash machine!

- Ranking: The largest Copper-Mines in the World!

- Xortx Therapeutics: Now it’s time for the final spurt!

- Delignit: Back on track!

- Beaconsmind: Digital solutions for store-based business

- Nippon Sanso: Moat und catch-up potential

- Ero Copper: A copper producer that hardly anyone knows

- Obsidian Energy: The big One among the smaller Oil-Producers

- Ranking: Best selling Gaming consoles in the World!

- Net Digital: A German payment service provider with AI!

Graphics: Das Investor Magazin, Uranium Energy

_____________________________________________________________________________________

DISCLAIMER. BITTE UNBEDINGT BEACHTEN!

Grundsätzlicher Hinweis auf mögliche Interessenskonflikte gemäß Paragraph 34 WpHG i.V.m. FinAnV: Mitarbeiter, Berater und freie Redakteure von www.investor-magazin.de können jederzeit Aktien an allen vorgestellten Unternehmen halten, kaufen oder verkaufen. Das gilt ebenso für abgeleitete Finanzinstrumente. Sollte dies der Fall sein, wird dies an dieser Stelle genannt.

Zudem weisen wir gerne auf die Broschüren der BaFin zum Schutz vor unseriösen Angeboten hin:

– Geldanlage – Wie Sie unseriöse Anbieter erkennen (pdf/113 KB)

– Wertpapiergeschäfte – Was Sie als Anleger beachten sollten (pdf/326 KB)

Risikohinweis: Wir weisen darauf hin, dass der Erwerb von Wertpapieren jeglicher Art hohe Risiken birgt, die zum Totalverlust des eingesetzten Kapitals führen können – oder darüber hinaus. Jegliche auf dieser Webseite verbreiteten Artikel rufen explizit nicht zum Kauf oder Verkauf von Wertpapieren auf. Es kommt weder eine Anlageberatung noch ein Anlagevermittlungsvertrag mit dem Leser zustande. Die hier dargestellten Informationen beziehen sich auf das Unternehmen und nicht auf die persönliche Situation des Lesers. Grundsätzlich möchten wir Ihnen Ideen für unseres Erachtens aussichtsreiche Investments geben. Bitte passen Sie diese dann an Ihre individuelle Strategie und persönliche Finanzsituation an. Und bitte vergessen Sie nicht: Wir haben keine Glaskugel, wir haben aber viel Erfahrung und Wissen. Daher raten wir stets dazu, dass Sie als Leser ihre eigenen Analysen vornehmen. Do your own Due Dilligence!

Datenschutz: Wir geben Ihre Daten nicht an externe Dritte weiter. Aufgrund der neuen Datenschutz Grundverordnung haben wir unsere Datenschutzerklärung aktualisiert. Sie können sich für unseren kostenlosen Newsletter hier anmelden. Eine Abmeldung ist jederzeit per Mail an info (at) investor-magazin.de möglich.

Keine Haftung für Links: Mit Urteil vom 12.Mai 1998 hat das Landgericht Hamburg entschieden, dass man durch die Ausbringung eines Links die Inhalte der verlinkten Seiten ggf. mit zu verantworten hat. Dies kann nur dadurch verhindert werden, dass man sich ausdrücklich von diesem Inhalt distanziert. Für alle Links auf dieser Webseite gilt: Der Betreiber distanziert sich hiermit ausdrücklich von allen Inhalten aller verlinkten Seiten und macht sich diese Inhalte nicht zu Eigen.

Keine Finanzanalyse: Der Herausgeber weist ausdrücklich darauf hin, dass es sich bei den Besprechungen um keine Finanzanalysen nach deutschem Kapitalmarktrecht handelt, sondern um journalistische und/oder werbliche Texte. Sie erfüllen deshalb nicht die Anforderungen zur Gewährleistung der Objektivität von Anlageempfehlungen. Bitte beachten Sie außerdem: Die Nutzung dieses Informationsangebots ist ausschließlich natürlichen Personen vorbehalten, die ihren dauerhaften Wohnsitz in der Bundesrepublik Deutschland haben. Allen anderen natürlichen oder juristischen Personen oder Personengruppen ist die Nutzung wie auch der Zugang zu dieser Webseite nicht gestattet.

Urheberrecht: Der Inhalt und die Struktur dieser Webseite sind urheberrechtlich geschützt und Eigentum des Betreibers. Sie dürfen nicht ohne vorherige schriftliche Zustimmung weder verwendet noch reproduziert werden, auch nicht auszugsweise. Der Betreiber ist bestrebt, in allen seinen Publikationen die Urheberrechte der verwendeten Grafiken, Bilder und Texte zu beachten. Allein aufgrund der bloßen Nennung oder Nichtnennung von Rechten Dritter ist nicht der Schluss zu ziehen, dass diese nicht geschützt sind! Sollte der Betreiber dennoch gegen Rechte Dritter verstoßen haben, wird er unter dem Vorbehalt der Prüfung unverzüglich jegliche Dateien entfernen, sofern er auf die Rechtsverletzung schriftlich hingewiesen wurde.

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr