Unknown, but incredibly successful! Aura Minerals was able to double its gold and copper production within five years by the end of 2023. It now aims to double again by the end of 2025. Despite this dynamic growth, the company has very solid finances and has so far been under the radar of many investors.

Target: 450,000 ounces of gold by the end of 2025

Rodrigo Barbosa, CEO of Aura Minerals (C$8.50; $ORA), outlined his company’s ambitious growth plans at the Precious Metals Summit in Beaver Creek (Colorado) in September 2023. He wants to produce 450,000 ounces of gold equivalent per year by the end of 2025. To achieve these 450,000 gold equivalent ounces (GEO), three new mines are being built. All three are located in Brazil. Almas, an open-cast mine, has already started production and is scheduled to ramp up in 2024. Borborema is under construction and the investment costs (CapEx) of USD 188 million are largely covered under a royalty agreement. A feasibility study has been carried out for Matupa. Although some approvals are still pending, construction is scheduled to start this year. Aura Minerals already owns three producing mines in Mexico, Honduras and Brazil.

Aura Minerals: stabilization on the cost side

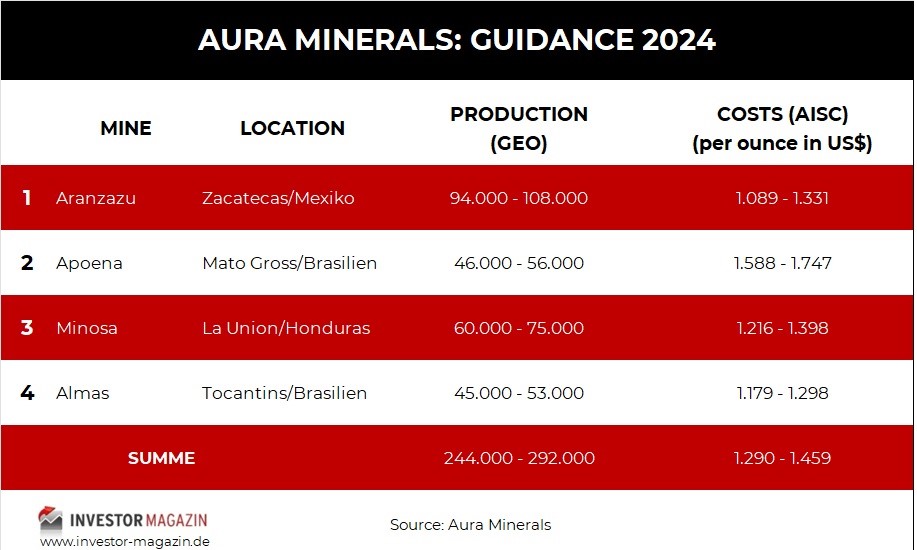

Rodrigo Barbosa is confident that production costs have stabilized in the meantime. In 2021 and 2022, these had increased significantly – as in the industry as a whole. For the new projects, he expects an increase of 15% to 20%: “Nevertheless, we managed to build Almas without exceeding the planned budget.” It was not only the local team’s cost savings that contributed to this. A generous safety buffer was already built in when calculating the construction costs. Aura Minerals expects all-in sustaining costs (AISC) of USD 1,290-1,459 per ounce for 2024. The AISCs of the new projects are expected to be below USD 1,000 per ounce.

Synergies from three new mines

The CEO primarily sees technical synergies at the new mines. What was learned during the construction of Almas will be applied at Borborema. And then the construction of the Matupa mine will follow. The company itself sees Brazil as a good location for a mining company as long as it adheres to ethical principles in terms of ESG standards. “If you create jobs for the local population and train them, you are welcome as an investor. But you can’t build a mine against the will of the local population,” says Barbosa. The company is particularly proud of one thing: there was not a single significant operational accident in 2023.

Aura Minerals is aiming for a ratio of two-thirds gold to one-third copper in terms of revenue. As the three new mines are all gold mines, the company is interested in a takeover in the copper sector: “The difficult market at the moment is good for acquisitions,” believes Barbosa. In November, a “strategic investment” of C$ 3 million was made in the Canadian explorer Altamira Gold (corresponding to a share of 11.35%), which has a large project in Brazil. However, this is only a small step.

2023: Year of transition

On February 20, Aura Minerals presented the figures for the recently completed financial year 2023, which can be described as a year of transition. Production fell slightly compared to 2022 from 241,421 to 235,856 GEO, but was up year-on-year in the fourth quarter. Remarkably, the cash position grew from US$ 127.9 million to US$ 237.3 million (both as at December 31) despite the expenditure for Almas, while net debt rose only slightly from US$ 77.4 million to US$ 85.2 million.

If you look at the figures for 2023 and the guidance for 2024, you quickly realize why Aura Minerals can grow strongly without ruining the balance sheet and even pay out a high dividend or buy back its own shares: The company generates stable free cash flows (2023: US$ 88 million) and only builds smaller mines that it can pay for without financial dislocation.

Aura Minerals: Production profile

Four mines are currently in operation. Aura Minerals expects production of 70% gold and 30% copper. In total, the management expects production of between 244,000 and 292,000 GEO. Costs (according to AISC) are expected to be between US$ 1,290 and US$ 1,459 per ounce. With the upper value, Aura Minerals would still be slightly below the cost level of the major gold companies.

The Borborema mine, which is currently under construction in Rio Grande do Norte, is designed for an annual production of 83,000 GEO and is expected to land at AISC costs of US$ 875 per ounce. Production is scheduled to start in 2025. Matupa, located in Mato Grosso, is expected to produce 55,000 GEO per year at a cost of just US$ 762. The construction costs for the mine (capex) amount to US$ 107 million.

Upside potential through resource expansion

In addition to its current development portfolio, Aura Minerals also has substantial upside potential through resource expansion. The company controls a substantial 630,000 hectare land package, of which only around 10% has been explored to date. Recent drilling has shown encouraging results. The Matupa project, for example, has relatively high resources that could be converted into reserves if required.

The share is significantly undervalued

Despite the operational outperformance of Aura Minerals, which really stands out in the industry, the share is still trading at a discount to its competitors. However, the prospect of production growth and the strong financial position speak in favor of the stock. According to analysts at Raymond James, the company is valued at just 0.35 NAV. Comparable medium-sized gold producers have an average NAV of 0.64. Based on the 2023 figures, the price/cash flow ratio is an extremely low 3.53. Echelon Capital Markets expects the price/cash flow ratio to fall towards 2.2 (2024) and 1.5 (2025) with the coming growth. The three Canadian analysts covering Aura Minerals shares all recommend buying the stock. The price targets range from C$ 14 (Canaccord) to C$ 14.50 (National Bank) to C$ 18 (Red Cloud). The price of Aura Minerals is currently around C$ 8.50. Incidentally, the major shareholder of Aura Minerals is Northwestern Enterprises, the private fund of Chairman Paulo Carlos de Brito. The Brazilian businessman holds 54.9% of the shares. The officially reported free float is 28%.

Why invest in Aura Minerals?

Aura Minerals is currently flying under the radar of most investors and is competing – in terms of attention – with around one to two dozen other mid-tier precious metals producers. The valuation gap offers an opportunity for a possible reclassification. Added to this is the high dividend. The current management took over the company in 2016 and has done an amazingly good job since then. The share looks very interesting on the chart. In 2019/2020, the share price multiplied in a steep jump upwards. Since then, the share price has corrected and roughly halved from the top. The price is currently entering a triangle. What is still missing is the breakout. The difference: In 2020, the P/E ratio was around 60, while the estimate for 2024 is 3.8. Conclusion: At the current level, the Aura Minerals share offers more opportunities than risks and represents a good combination of growth and balance sheet strength.

Please note: Investments in the capital markets are associated with a high level of risk. Investors can lose all of their capital – and more. Remember to do your own due diligence! The content of this website is intended exclusively for readers who are permanent residents of Germany. The German disclaimer applies (see below).

You might also be interested in…

- Redcare Pharmacy: E-Prescription provides more than just imagination

- Friwo promises a turnaround in 2024

- Bitcoin: Is the perfect storm brewing here?

- Uranium Energy: Profit from the rising Uranium Price?

- Is Couer Mining a buy after 80% drop in share price?

- TUI: End of the Short attacks?

- Pan American Silver: Already on special offer?

- PNE Wind: A second chance for investors?

- Nvidia: Demolished expectations!

- Apple: Buy the dip?

- Artemis Gold: This share travels under the Radar!

- Exasol: Still waiting for the turnaround!

- Redcare Pharmacy shows strong growth!

- Covestro: Adnoc increases takeover bid!

- Royal Helium: Noble Gases for the Space Industry!

- Marathon Gold: The next gold mine in Newfoundland!

- Ranking: The most innovative Companies in the World

- Tourmaline Oil: Betting on a higher natural gas price

- Banyan Gold: New Gold rush in the Yukon!

- DHT Holdings: Tankers as cash machine!

- Ranking: The largest Copper-Mines in the World!

- Xortx Therapeutics: Now it’s time for the final spurt!

- Delignit: Back on track!

- Beaconsmind: Digital solutions for store-based business

- Nippon Sanso: Moat und catch-up potential

- Ero Copper: A copper producer that hardly anyone knows

- Obsidian Energy: The big One among the smaller Oil-Producers

- Ranking: Best selling Gaming consoles in the World!

- Net Digital: A German payment service provider with AI!

Graphics: Das Investor Magazin, Pixabay, Aura Minerals

_____________________________________________________________________________________

DISCLAIMER. BITTE UNBEDINGT BEACHTEN!

Grundsätzlicher Hinweis auf mögliche Interessenskonflikte gemäß Paragraph 34 WpHG i.V.m. FinAnV: Mitarbeiter, Berater und freie Redakteure von www.investor-magazin.de können jederzeit Aktien an allen vorgestellten Unternehmen halten, kaufen oder verkaufen. Das gilt ebenso für abgeleitete Finanzinstrumente. Sollte dies der Fall sein, wird dies an dieser Stelle genannt.

Zudem weisen wir gerne auf die Broschüren der BaFin zum Schutz vor unseriösen Angeboten hin:

– Geldanlage – Wie Sie unseriöse Anbieter erkennen (pdf/113 KB)

– Wertpapiergeschäfte – Was Sie als Anleger beachten sollten (pdf/326 KB)

Risikohinweis: Wir weisen darauf hin, dass der Erwerb von Wertpapieren jeglicher Art hohe Risiken birgt, die zum Totalverlust des eingesetzten Kapitals führen können – oder darüber hinaus. Jegliche auf dieser Webseite verbreiteten Artikel rufen explizit nicht zum Kauf oder Verkauf von Wertpapieren auf. Es kommt weder eine Anlageberatung noch ein Anlagevermittlungsvertrag mit dem Leser zustande. Die hier dargestellten Informationen beziehen sich auf das Unternehmen und nicht auf die persönliche Situation des Lesers. Grundsätzlich möchten wir Ihnen Ideen für unseres Erachtens aussichtsreiche Investments geben. Bitte passen Sie diese dann an Ihre individuelle Strategie und persönliche Finanzsituation an. Und bitte vergessen Sie nicht: Wir haben keine Glaskugel, wir haben aber viel Erfahrung und Wissen. Daher raten wir stets dazu, dass Sie als Leser ihre eigenen Analysen vornehmen. Do your own Due Dilligence!

Datenschutz: Wir geben Ihre Daten nicht an externe Dritte weiter. Aufgrund der neuen Datenschutz Grundverordnung haben wir unsere Datenschutzerklärung aktualisiert. Sie können sich für unseren kostenlosen Newsletter hier anmelden. Eine Abmeldung ist jederzeit per Mail an info (at) investor-magazin.de möglich.

Keine Haftung für Links: Mit Urteil vom 12.Mai 1998 hat das Landgericht Hamburg entschieden, dass man durch die Ausbringung eines Links die Inhalte der verlinkten Seiten ggf. mit zu verantworten hat. Dies kann nur dadurch verhindert werden, dass man sich ausdrücklich von diesem Inhalt distanziert. Für alle Links auf dieser Webseite gilt: Der Betreiber distanziert sich hiermit ausdrücklich von allen Inhalten aller verlinkten Seiten und macht sich diese Inhalte nicht zu Eigen.

Keine Finanzanalyse: Der Herausgeber weist ausdrücklich darauf hin, dass es sich bei den Besprechungen um keine Finanzanalysen nach deutschem Kapitalmarktrecht handelt, sondern um journalistische und/oder werbliche Texte. Sie erfüllen deshalb nicht die Anforderungen zur Gewährleistung der Objektivität von Anlageempfehlungen. Bitte beachten Sie außerdem: Die Nutzung dieses Informationsangebots ist ausschließlich natürlichen Personen vorbehalten, die ihren dauerhaften Wohnsitz in der Bundesrepublik Deutschland haben. Allen anderen natürlichen oder juristischen Personen oder Personengruppen ist die Nutzung wie auch der Zugang zu dieser Webseite nicht gestattet.

Urheberrecht: Der Inhalt und die Struktur dieser Webseite sind urheberrechtlich geschützt und Eigentum des Betreibers. Sie dürfen nicht ohne vorherige schriftliche Zustimmung weder verwendet noch reproduziert werden, auch nicht auszugsweise. Der Betreiber ist bestrebt, in allen seinen Publikationen die Urheberrechte der verwendeten Grafiken, Bilder und Texte zu beachten. Allein aufgrund der bloßen Nennung oder Nichtnennung von Rechten Dritter ist nicht der Schluss zu ziehen, dass diese nicht geschützt sind! Sollte der Betreiber dennoch gegen Rechte Dritter verstoßen haben, wird er unter dem Vorbehalt der Prüfung unverzüglich jegliche Dateien entfernen, sofern er auf die Rechtsverletzung schriftlich hingewiesen wurde.

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr

Das Investor Magazin Deutsche Aktien, Rohstoffaktien & mehr